Asia stocks tread water as tariff concerns persist; Tech eyes TSMC earnings

Market Brief

The US economy added 230’000 private jobs in October (vs 220K exp. & 213K a month ago). As the Fed-hawks remained in charge, the greenback and the US stocks were bid in New York. The US October NFPs and unemployment rate are due on Friday. The data is under close watch given the Fed’s shift toward a more data-dependent action plan in 2015.

In Australia, the economy added 24K new jobs in October (vs 20K exp. & -229.7K last). Full-time employment increased 33.4K (vs 26.4K last), while part-time employment decreased by 9.4K (vs. -51.3K). Given the recent uncertainties in Australian unemployment data (mostly believed to be due to modifications in rotation group), the market reaction remained limited. AUD/USD extended losses to fresh low of 0.8554, approaching RBA Governor Stevens’ will of an AUD at 85 US cents. The bearish momentum strengthens, option barriers trail down from 0.8700 for today expiry. We expect a short-term correction with first line of resistance seen at 0.8643 (former year low). The next critical support is at 0.8500 (psychological level), 0.8316/17 (July 2010 double bottom), then 0.8067 (2010 low). EUR/AUD technicals turn positive before the ECB decision. The MACD steps in the bull zone and the formation of a bullish engulfing (conviction 4/9) suggests further upside correction. Key resistance stands at 200-dma (1.46546) given the EUR event-risk.

Today’s key events are the BoE, ECB policy verdicts (at 12:00 GMT and 12:45 GMT respectively) and ECB President Draghi’s speech (at 13:30 GMT). Both central banks are expected to maintain the status quo. The BoE decision should be a non-event, while Draghi’s speech will be closely monitored and should give fresh short-run direction to EUR-complex. EUR/USD is currently consolidating losses at 2-year low levels. Trend and momentum indicators are marginally negative, yet the EUR risk is seen two sided at today’s meeting. We believe that the ECB is unlikely to proceed with additional easing push, that the EZ policymakers will more likely concentrate on covered bond and ABS purchases program. In this context, the absence of QE discussion should trigger some profit-taking/correction in EUR-complex. Important resistance in EUR/USD is placed at 1.2662/1.2755 (area including 13th November 2012 low, 21-dma and 7th July 2013 low). Large EUR/GBP vanilla expiries at 0.7850/0.7900 should cap the EUR-bull attempts.

GBP/USD tested 2014 low of 1.5875 on broad based USD strength yesterday. The Cable recovers pre-BoE. A daily close above 1.5957 (MACD pivot) should keep the bias marginally positive. Light offers are seen 1.6050/80 (21-dma / 30-day mid Bollinger band), more resistance is eyed at 1.6180/86 (50-dma / Fib 23.6% on Jul-Oct sell-off).

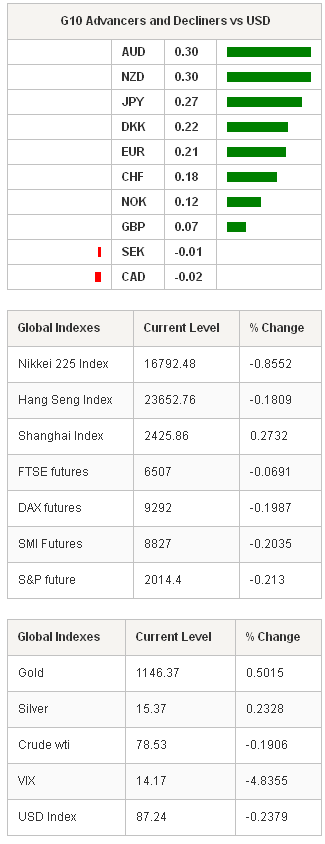

In the continuation of sliding oil prices, the OPEC’s crude traded below $80 for the first time in four years. Saudi Arabia and other OPEC members supply 40% of world’s oil production and refuse to temper their production according to slowdown in global demand. In the US, the crude inventories increased 460K barrels in week to October 31st, less than expected yet for the fifth consecutive week. It is believed that this is mostly a strategic war among leading oil producers to increase market share by pushing the less price-competitive competitors out of the game, just before the economic recovery gains traction. How far the price war will last is the key question. Oil exporter currencies – CAD, NOK and RUB – suffer important losses. USD/RUB hit a fresh all-time-high of 45.3575 so far, the momentum remains solidly positive as, in addition, the Central Bank of Russia announced the end of its predictable intervention policy, while allowing itself to sell unlimited quantities of FX to fight against speculative sell-off in RUB. We remain sellers on RUB, CAD and NOK.

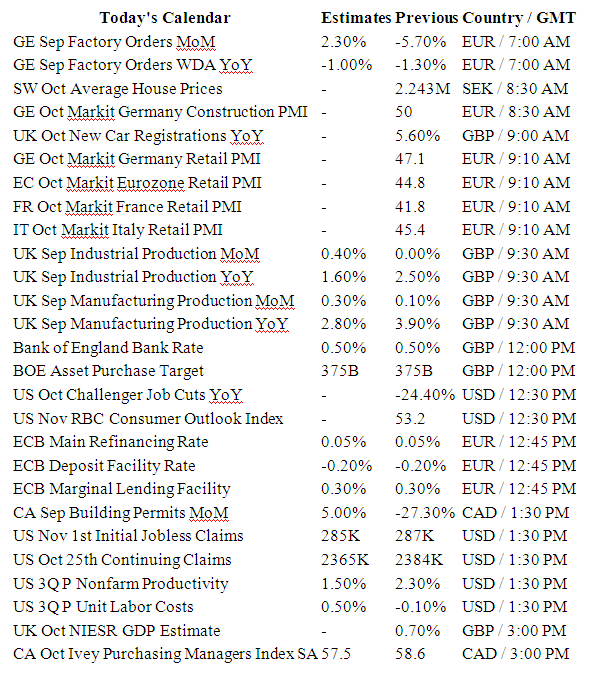

The economic calendar of today: German September Factory Orders m/m & y/y, Swedish October Average House Prices, German October Construction PMI, German, French, Italian and Euro-zone October Retail PMI, UK October New Car Registrations, UK September Industrial and Manufacturing Production m/m & y/y, UK October NIESR GDP Estimate, Canadian September Building Permits m/m, US November 1st Initial Jobless & October 25th Continuing Claims, US 3Q (Prelim) Nonfarm Productivity and Unit Labor Costs and Canadian October Ivey Purchasing Manager Index SA.

Currency Tech

EURUSD

R 2: 1.2662

R 1: 1.2577

CURRENT: 1.2509

S 1: 1.2475

S 2: 1.2440

GBPUSD

R 2: 1.6186

R 1: 1.6050

CURRENT: 1.5988

S 1: 1.5855

S 2: 1.5738

USDJPY

R 2: 116.00

R 1: 115.52

CURRENT: 114.40

S 1: 113.17

S 2: 112.50

USDCHF

R 2: 0.9751

R 1: 0.9692

CURRENT: 0.9626

S 1: 0.9580

S 2: 0.9544

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI