AUD/USD

After showing some resilience earlier last week moving to a one week high above 0.9150, the AUD/USD finished out last week turning around sharply and falling heavily down to a three month low close to 0.89. For the last few days the Australian dollar has done very little trading right around 0.8950 as it feels some selling pressure from near 0.90. After all of its steady good work several weeks ago in the middle of November which saw the AUD/USD steadily move higher from support at 0.93 back up to a one week high near 0.9450, the AUD/USD has since returned all of those gains and some. After settling around the 0.95 level for over a week earlier last month, the AUD/USD started to drift lower back towards the support at 0.93. Throughout most of October the AUD/USD enjoyed a solid and steady move higher from the support level at 0.93 up to the resistance level at 0.95 and beyond to a high around 0.9760.

Throughout the first half of September the AUD/USD enjoyed a solid run which was punctuated by a strong surge higher sending it to a then three month high just above 0.95. A couple of months ago the AUD/USD had been trying valiantly to stay above the support level at 0.89 as all week it placed downward pressure but was unable to sustain any break lower. At the beginning of August it moved very well from three year lows to move back above the key level of 90 cents and beyond to a two week high just above 0.92 to finish out that week. At the end of July the AUD/USD fell very strongly and appeared to resume the medium term down trend as it moved to a new three year low near 0.8850 but it reversed very well and looked poised to continue back towards the longer term resistance level at 0.93. For the most part of the last week, it moved very little and was quite subdued staying above the support level at 0.94.

Throughout July the AUD/USD placed constant pressure on the 0.93 level again as it continued to place buying pressure on that level however the resistance there was able to stand firm. It was during this time it did very well to maintain its price level well above 0.92 as place upward buying pressure on the resistance level at 0.93. Throughout July, the AUD/USD spent most of its time trading between 0.90 and 0.93 threatening to break through either level at multiple stages. The 0.9150 level also became a key level during that time providing both some resistance and more recently support, and this was called upon again a few weeks ago providing some much needed support however it was completely ignored a couple of weeks ago as the AUD/USD fell heavily through it. Considering the speed of its decline throughout several months this year, the second half of this year has seen a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 several times. Throughout April to August, the AUD/USD established a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time.

The Australian dollar slumped to its lowest levels in three months Friday, following comments by the country’s central bank governor, making it the worst performing top-10 currency globally in the last 24 hours. Reserve Bank of Australia Gov. Glenn Stevens told the Australian Financial Review in an interview, published Friday that the currency made a lot more sense trading in the mid US$0.85 cent region, rather than US$0.95. Mr. Stevens said he would prefer to see stimulus delivered to the sluggish economy through a lower currency, rather than through further cuts to interest rates, which are already at record lows. AUD/USD Daily Chart" title="AUD/USD Daily Chart" height="234" width="550">

AUD/USD Daily Chart" title="AUD/USD Daily Chart" height="234" width="550"> AUD/USD 4 Hourly Chart" title="AUD/USD 4 Hourly Chart" height="234" width="550">

AUD/USD 4 Hourly Chart" title="AUD/USD 4 Hourly Chart" height="234" width="550">

AUD/USD December 16 at 22:15 GMT 0.8943 H: 0.8969 L: 0.8927 AUD/USD Technical Chart" title="AUD/USD Technical Chart" height="234" width="550">

AUD/USD Technical Chart" title="AUD/USD Technical Chart" height="234" width="550">

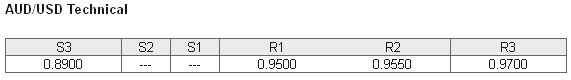

During the early hours of the Asian trading session on Tuesday, the AUD/USD continues to trade around the 0.8950 level after doing very little for the last couple of days. Despite its strong recovery in September, the Australian dollar has been in a free-fall for a lot of this year. Current range: trading just below 0.8950.

Further levels in both directions:

• Below: 0.8900.

• Above: 0.9500, 0.9550 and 0.9700. AUD/USD Position Ratios" title="AUD/USD Position Ratios" height="234" width="550">

AUD/USD Position Ratios" title="AUD/USD Position Ratios" height="234" width="550">

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has moved back below 70% as the Australian dollar has fallen below 0.90 for the first time in three months. The trader sentiment remains in favour of long positions.

Economic Releases

- 00:30 AU RBA minutes of prior December meeting

- 09:30 UK CPI (Nov)

- 09:30 UK Input & Output Prices (Nov)

- 09:30 UK ONS House Prices (Oct)

- 10:00 EU Employment (Q3)

- 10:00 EU HICP (Final) (Nov)

- 10:00 EU Labour Cost Index (Q3)

- 10:00 EU ZEW Survey (Dec)

- 13:30 CA Manufacturing sales (Oct)

- 13:30 US CPI (Nov)

- 13:30 US Current Account (Q3)

- 15:00 US NAHB Builders survey (Dec)

- EU EU General Affairs Ministers hold meeting in Brussels

- US Federal Reserve FOMC meeting (to 18th)

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI