Talking Points

- AUD/USD Moves to R4 Resistance

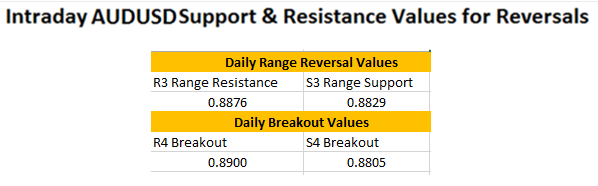

- Today’s Range Begins at .8876

- Bearish Reversals Triggered Under .8805

(Created using FXCM’s Marketscope 2.0 charts)

The AUD/USD has opened higher on expectations that the pending FOMC policy event will send the US Dollar continually lower. In the event price moves above .8900, this would signal the possibility of a fresh breakout above the R4 pivot point. In the event that price stays below this value, paired with potentially hawkish rhetoric from the fed, traders can begin looking for reversals of price back towards support.

A break in price back below range resistance at the R3 pivot, would signal a reversal to US Dollar strength. In this scenario traders can begin looking for a decline in the AUD/USD back to prices of support, starting with the S3 pivot at .8829. Conversely, a move blow today’s final value of support at the S4 pivot at .8805, would signal a larger price reversal on the creation of a new lower low back in the direction of the pairs primary trend. In this scenario, traders can take a breakout beneath support as a shift in the market, and begin looking to trade the AUD/USD’s new direction.

Are you new to trading with pivot points? To become more familiar with Camarill Pivots and how to use them for day trading FX Reversals, check out the suggested reading links below. This way you can continue your trading education, while working towards actively incorporating pivot points into your selected day trading strategy.

---Written by Walker England, Trading Instructor

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.