Stock market today: S&P 500 in weekly loss as trade war fears intensifyy

Talking Points

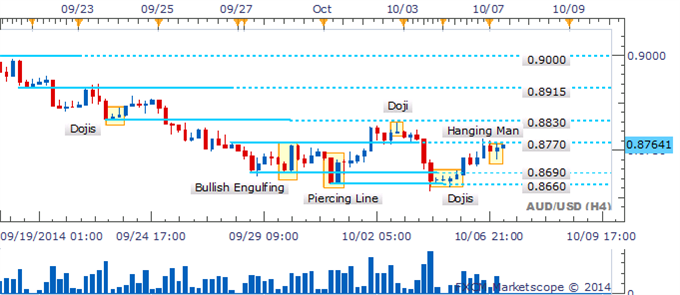

- AUD/USD Technical Strategy: Sidelines Preferred

- Piercing Line Near 0.8660 Awaiting Confirmation

- Close Over 0.8815 Ceiling Needed To Suggest A Base

AUD/USD’s sharp rebound from the 0.8660 floor has generated a Piercing Line candlestick pattern. Yet with strong selling pressure overhead the potential for the reversal pattern to generate a genuine shift in sentiment may be limited. A daily close over the 0.8815 hurdle would be required to suggest a base and could conceivably open a retest of the 0.8885 ceiling.

AUD/USD: Key Reversal Pattern Emerges Near 2014 Low

The four hour chart suggests the Aussie’s recovery is already showing signs of exhaustion. An ensemble of Dojis, short body candles and a Hanging Man indicate that upside momentum is fading. This could open a revisit of the recent lows near 0.8660.

AUD/USD: Recovery Shows Signs Of Exhaustion In Intraday Trade