Talking Points:

- AUD/USD Technical Strategy: Flat

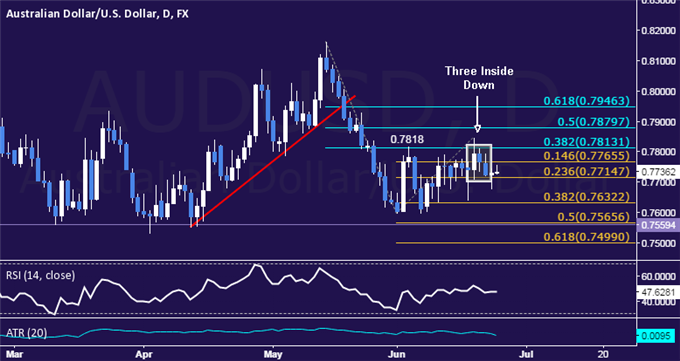

- Support: 0.7715, 0.7632, 0.7566

- Resistance:0.7766, 0.7818, 0.7880

The Australian dollar may be preparing to resume the down trend against its US namesake after producing a bearish Three Inside Down candlestick pattern. Near-term support is at 0.7715, the 23.6% Fibonacci expansion, with a break below that on a daily closing basis exposing the 38.2% level at 0.7632. Alternatively, a turn above the 14.6% Fib at 0.7766 opens the door for a test of the 0.7813-18 area (38.2% Fib retracement, June 3 high).

Prices are wedged too closely between near-term support and resistance levels to justify taking a trade on a long or short side from a risk/reward perspective. With that in mind, we will continue to stand aside until a more attractive opportunity presents itself.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.