Trump announces 50% tariff on copper, effective August 1

Post-Friday charts show trouble ahead?

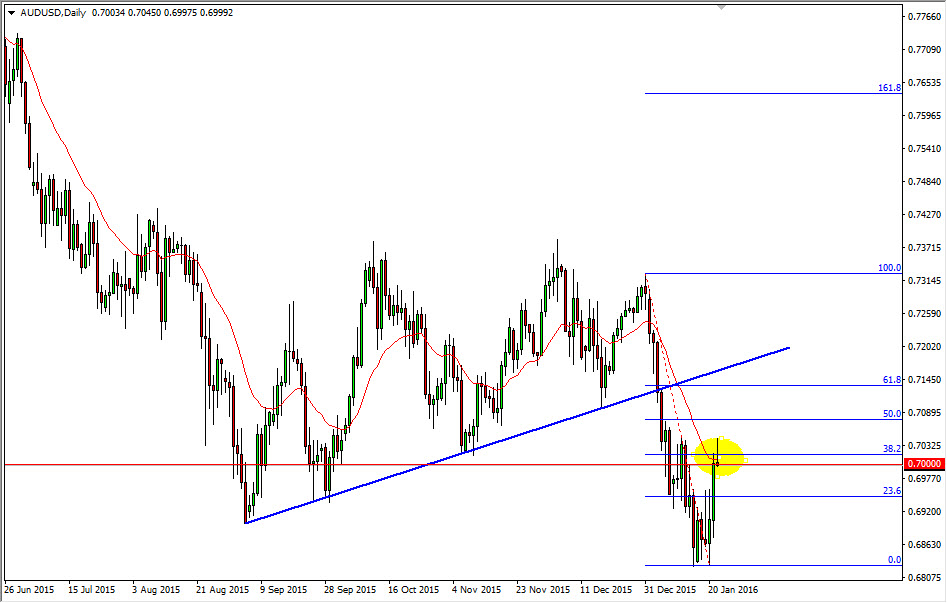

After the Friday session, we took a look at the AUD/USD pair and were very interested in trading yet again. We have had several trades to the down side lately, as the trend has been very reliable overall. One of the biggest reasons in my opinion is that the Chinese markets and economic numbers have left a lot to be desired. Remember, many currency traders will use the Australian dollar as a proxy for China, as the Aussies provide so much in the way of raw materials for Chinese industry and construction.

The markets initially tried to rally on Friday, but pulled back in order to form a shooting star. Further making this of importance is the fact that it was at the psychologically important 0.70 level. Anytime we get a very bullish or bearish candle at a round number like this, we pay attention. It is normally a secondary signal in and of itself. The shape of the candle is perfect, and as a result this got us looking a bit closer.

Resistance for the Aussie dollar

The chart also features a sign of resistance at the 38.2% Fibonacci level , which is just above current pricing. The 20 day exponential moving average is also here, so at the end of the day, we like the idea of shorting at this point in time. This could very well just be a simple return to the bottom of the recent consolidation area, meaning a move to the 0.68 level below could be in the cards. Also, we believe that there will be a serious lack of comfort going forward in this market, even if we broke above the top of the shooting star – which would normally have us buying, but in this case we have the previous uptrend line that had been so supportive, so we think the market will recognize it as resistance in the short-term. So at this point, we are sellers – either on a break below the range for the Friday session, or an exhaustive candle above. We have no real interest in buying the Aussie at the moment, but recognize that there are signs of life in the stocks markets after Friday, so we could find a lot of volatility soon.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI