Analyst flags 9 bargain stocks in a ‘Black Friday’-style dip

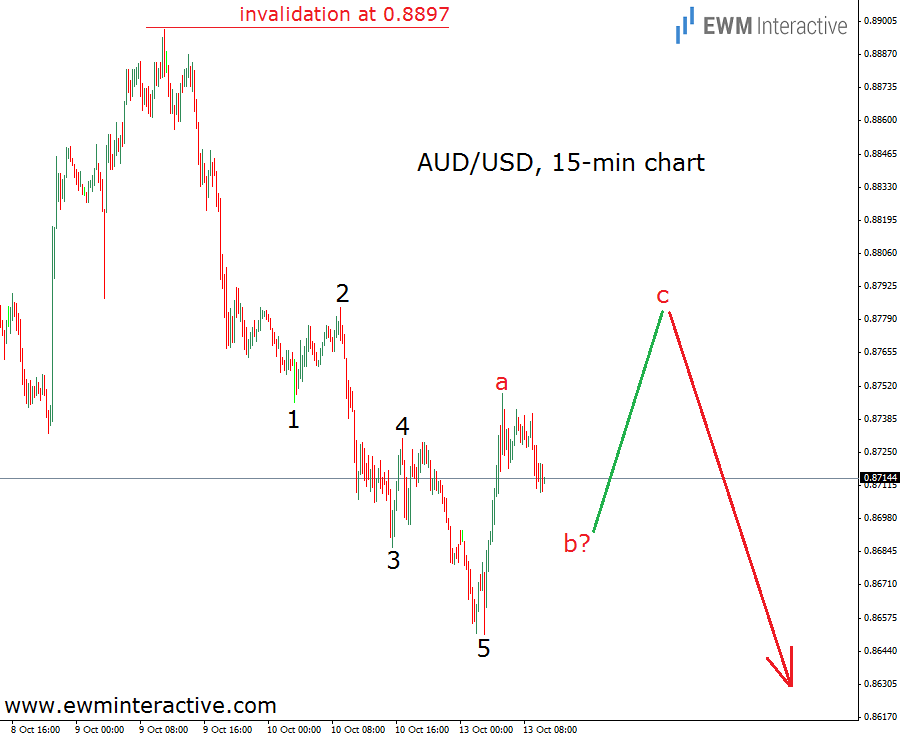

It looks like the downtrend in AUDUSD still has room to develop, because on the 15-min chart there is a clear five-wave structure, also known as an impulse. According to the Elliott Wave Principle, every impulse is followed by a three-wave correction in the opposite direction. Then the trend is expected to resume in the direction of the five-wave sequence. The chart below shows what we are talking about.

As you can see, AUDUSD rose sharply from the bottom at 0.8650, which we think is wave “a” of an a-b-c zig-zag corrective recovery. If this is the correct count, we should expect wave “c” to the upside, before the bears return.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 2 out of 3 global portfolios are beating their benchmark indexes, with 88% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?