Bitcoin price today: near $119k after trade cheer; Fed, crypto report eyed

The AUD/USD has experienced an ordinary few days which has seen it fall strongly and move through the key 90 cents level to a two week low just above 0.8950. It rallied well to finish last week moving from below 0.91 back towards the short term resistance level at 0.92, however it has since experienced the decline and sold off quite heavily.

Toward the end of last week, it moved wildly within a 24 hour period from near 0.92 down to 0.9060 very quickly before rallying and moving back towards 0.9150 again. In the week prior it moved very well from three year lows to move back above the key level of 90 cents and beyond to a two week high just above 0.92 to finish out last week. A few weeks ago, it fell very strongly and appeared to resume the medium term down trend as it moved to a new three year low near 0.8850 but it reversed very well and looked poised to continue back towards the longer term resistance level at 0.93 before its obstacle at 0.92. It was only a few weeks ago the AUD/USD moved up towards the 0.93 level again as it continued to place buying pressure on that level. It was during this time it did very well to maintain its price level well above 0.92 as place upward buying pressure on the resistance level at 0.93 however a few weeks ago, it fell sharply to back under 0.92 and started to place pressure on the short term support level of 0.9150.

Over the course of the last month or more the 0.93 level has provided reasonable resistance to any movement higher and this level will likely play a role again should the AUD/USD continues its rally up above 0.92. Throughout July, the AUD/USD spent most of its time trading between 0.90 and 0.93 threatening to break through either level at multiple stages.

The 0.9150 level also became a key level during that time, providing both some resistance and more recently support, and this was called upon again a few weeks ago providing some much needed support however it was completely ignored a couple of weeks ago as the AUD/USD fell heavily through it. It was only a month or so ago that many were waiting for the AUD/USD to break below the 90 cent level and then it would have been a matter of how far can it drop. It had continued to drift lower and move towards the 90 cents level, a level not seen for three years. Considering the speed of its decline over the last few months, the last month or so saw a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 and made its way back to 0.93 on a few occasions.

The last few months have seen the AUD/USD establish a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time. In doing so, it has completely ignored any likely support at previous key levels at 1.04, 1.0360 and 1, and more recently the long term support level at 0.97. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. After making a solid run higher in the middle of June back towards the key level of 0.97, the

Australian releases continue to point to trouble and this was underscored by a very weak New Motor Vehicles Sales release earlier this week. The release declined 3.5%, its sharpest drop in over two years. The indicator is an important gauge of consumer spending, since cars and trucks are big-ticket items and a decrease in sales points to lower consumer confidence and spending.

On Tuesday, the RBA released the minutes of its most recent policy meeting. At the meeting, the RBA decided to lower rates from 2.75% to 2.50%. The central bank said that another interest rate cut is not imminent. This was good news for the Aussie, as another interest rate cut would make the currency less attractive to investors.

The RBA also indicated that it would welcome further depreciation of the Australian dollar in order to strengthen the economy. The bottom line? The RBA would prefer not to have to reduce interest rates in the near future, but is prepared to act if the Australian dollar moves higher and pulls away from the 0.90 level. The Aussie has lost some 11% in the past six months, and it’s clear that the RBA does not want it returning to high levels.

AUD/USD August 21 at 23:25 GMT 0.8974 H: 0.9058 L: 0.8965

During the early hours of the Asian trading session on Thursday, the AUD/USD is rallying back a little from the support level at 91 cents. Despite its slowing and slight recovery the last month or so, the Australian dollar has been in the middle of a free-fall, as the currency has lost around 15 cents since the beginning of May. In moving through to 1.0580 only a few months ago, it moved to its highest level since January. Current range: trading just above 0.91 around 0.9130.

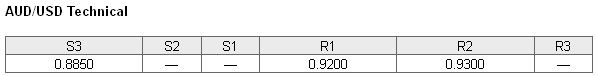

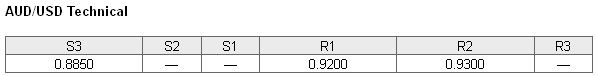

Further levels in both directions:

• Below: 0.8850

• Above: 0.9200 and 0.9300

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has moved up towards 70% as the Australian dollar has fallen back through the key level of 0.90. The trader sentiment remains in favour of long positions.

Economic Releases

Toward the end of last week, it moved wildly within a 24 hour period from near 0.92 down to 0.9060 very quickly before rallying and moving back towards 0.9150 again. In the week prior it moved very well from three year lows to move back above the key level of 90 cents and beyond to a two week high just above 0.92 to finish out last week. A few weeks ago, it fell very strongly and appeared to resume the medium term down trend as it moved to a new three year low near 0.8850 but it reversed very well and looked poised to continue back towards the longer term resistance level at 0.93 before its obstacle at 0.92. It was only a few weeks ago the AUD/USD moved up towards the 0.93 level again as it continued to place buying pressure on that level. It was during this time it did very well to maintain its price level well above 0.92 as place upward buying pressure on the resistance level at 0.93 however a few weeks ago, it fell sharply to back under 0.92 and started to place pressure on the short term support level of 0.9150.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Over the course of the last month or more the 0.93 level has provided reasonable resistance to any movement higher and this level will likely play a role again should the AUD/USD continues its rally up above 0.92. Throughout July, the AUD/USD spent most of its time trading between 0.90 and 0.93 threatening to break through either level at multiple stages.

The 0.9150 level also became a key level during that time, providing both some resistance and more recently support, and this was called upon again a few weeks ago providing some much needed support however it was completely ignored a couple of weeks ago as the AUD/USD fell heavily through it. It was only a month or so ago that many were waiting for the AUD/USD to break below the 90 cent level and then it would have been a matter of how far can it drop. It had continued to drift lower and move towards the 90 cents level, a level not seen for three years. Considering the speed of its decline over the last few months, the last month or so saw a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 and made its way back to 0.93 on a few occasions.

The last few months have seen the AUD/USD establish a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time. In doing so, it has completely ignored any likely support at previous key levels at 1.04, 1.0360 and 1, and more recently the long term support level at 0.97. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. After making a solid run higher in the middle of June back towards the key level of 0.97, the

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

AUD/USD has since continued its strong and steady decline moving to below 0.90 and levels not seen since near the middle of 2010. This has seen it experience a significant strong trend that would have likely caught many people on its wrong side. Australian releases continue to point to trouble and this was underscored by a very weak New Motor Vehicles Sales release earlier this week. The release declined 3.5%, its sharpest drop in over two years. The indicator is an important gauge of consumer spending, since cars and trucks are big-ticket items and a decrease in sales points to lower consumer confidence and spending.

On Tuesday, the RBA released the minutes of its most recent policy meeting. At the meeting, the RBA decided to lower rates from 2.75% to 2.50%. The central bank said that another interest rate cut is not imminent. This was good news for the Aussie, as another interest rate cut would make the currency less attractive to investors.

The RBA also indicated that it would welcome further depreciation of the Australian dollar in order to strengthen the economy. The bottom line? The RBA would prefer not to have to reduce interest rates in the near future, but is prepared to act if the Australian dollar moves higher and pulls away from the 0.90 level. The Aussie has lost some 11% in the past six months, and it’s clear that the RBA does not want it returning to high levels.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

AUD/USD August 21 at 23:25 GMT 0.8974 H: 0.9058 L: 0.8965

During the early hours of the Asian trading session on Thursday, the AUD/USD is rallying back a little from the support level at 91 cents. Despite its slowing and slight recovery the last month or so, the Australian dollar has been in the middle of a free-fall, as the currency has lost around 15 cents since the beginning of May. In moving through to 1.0580 only a few months ago, it moved to its highest level since January. Current range: trading just above 0.91 around 0.9130.

Further levels in both directions:

• Below: 0.8850

• Above: 0.9200 and 0.9300

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has moved up towards 70% as the Australian dollar has fallen back through the key level of 0.90. The trader sentiment remains in favour of long positions.

Economic Releases

- 07:58 EU Flash Composite PMI (Aug)

- 07:58 EU Flash Manufacturing PMI (Aug)

- 07:58 EU Flash Services PMI (Aug)

- 12:30 CA Retail Sales (Jun)

- 12:30 US Initial Claims (16/08/2013)

- 12:58 US Flash Manufacturing PMI (Aug)

- 13:00 US FHFA House Price Index (Jun)

- 14:00 US Leading Indicator (Jul)

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI