Bank earnings loom large; CPI ahead; Nvidia’s China chip - what’s moving markets

Talking Points

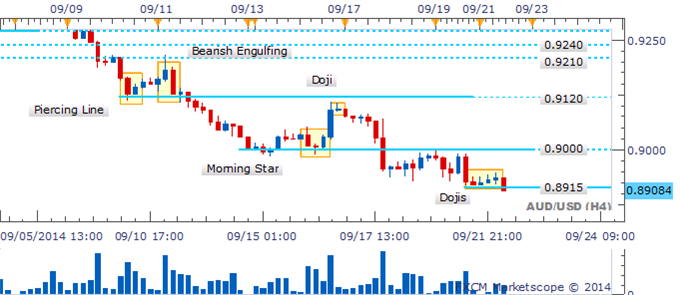

- AUD/USD Technical Strategy: Shorts Preferred

- Absence of Key Reversal Patterns Casts Risks Lower

- Break Below 0.8885/90 To Open Run On 0.8660

The Australian Dollar remains at risk following a failure to reclaim the 90 US cent handle coupled with an absence of bullish reversal signals. This leaves the spotlight on the 0.8885 barrier, which if broken would open the next leg lower to the 2014 lows near 0.8660.

AUD/USD: Downside Risks Remain While Sub 0.9000

Daily Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

A parade of Doji formations on the four hour chart indicates hesitation from traders to lead the pair lower. Yet at the same time this may not suggest a potential recovery, given the lack of key reversal patterns. Sellers are likely to reemerge at former support-turned-resistance near 0.9000.

AUD/USD: Dojis Highlight Hesitation From Traders Near 0.8915 Barrier