The Australian dollar continues to drift lower. In the past 12 hours it has reached a new three month low below 0.89.

After showing some resilience earlier last week moving to a one week high above 0.9150, the AUD/USD finished out last week by turning around sharply and falling heavily down to a then three month low, close to 0.89. For the last few days the Australian dollar has done very little trading, remaining right around 0.8950 before drifting lower to 0.89 today. After all of its steady good work several weeks ago in the middle of November which saw the AUD/USD steadily move higher from support at 0.93 back up to a one week high near 0.9450, the AUD/USD has since returned all of those gains and then some. After settling around the 0.95 level for over a week earlier last month, the AUD/USD started to drift lower, back towards the support at 0.93. Throughout most of October the AUD/USD enjoyed a solid and steady move higher from the support level at 0.93 up to the resistance level at 0.95 and beyond to a high around 0.9760.

Throughout the first half of September, the AUD/USD enjoyed a solid run which was punctuated by a strong surge higher sending it to a then three month high just above 0.95. A couple of months ago the AUD/USD had been trying valiantly to stay above the support level at 0.89 as all week it placed downward pressure but was unable to sustain any break lower. At the beginning of August it moved very well from three year lows to back above the key level of 90 cents and beyond, to a two week high just above 0.92 to finish out that week. At the end of July the AUD/USD fell very strongly and appeared to resume the medium term down trend as it moved to a new three year low near 0.8850 but it reversed very well and looked poised to continue back towards the longer term resistance level at 0.93. For the most part of the last week, it moved very little and was quite subdued staying above the support level at 0.94.

Throughout July the AUD/USD placed constant pressure on the 0.93 level again as it continued to place buying pressure on that level however the resistance there was able to stand firm. It was during this time it did very well to maintain its price level well above 0.92 as place upward buying pressure on the resistance level at 0.93. Throughout July, the AUD/USD spent most of its time trading between 0.90 and 0.93 threatening to break through either level at multiple stages. The 0.9150 level also became a key level during that time providing both some resistance and more recently support, and this was called upon again a few weeks ago providing some much needed support however it was completely ignored a couple of weeks ago as the AUD/USD fell heavily through it. Considering the speed of its decline throughout several months this year, the second half of this year has seen a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 several times. Throughout April to August, the AUD/USD established a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time.

Australia's government, led by new Prime Minister Tony Abbott, said its budget deficit could swell to 47 billion Australian dollars ($42 billion) in the year ending June 2014, according to its latest mid-year economic and fiscal report released Tuesday. This is a substantial increase from the 30.1 billion Australian dollars forecast by the previous Labour government back in August. Gross domestic product growth for the current fiscal year is expected to come in at 2.5 percent, unchanged from the Treasury's forecast before the elections in September, but still a far cry from quarterly growth rates of as high as 4 percent last year.

Addressing reporters in Canberra, Treasurer Joe Hockey said that the budget deficit would balloon to 123 billion Australia dollars over the next four years, and, without policy changes, the budget would be in deficit every year until 2024. "The current budget is not sustainable. Doing nothing is not an option for Australia," said Hockey. "We will fix the budget. We will deliver a stronger economy. But it will need a response that has the support and active involvement of the entire Australian economy."

AUD/USD December 17 at 22:25 GMT 0.8895 H: 0.8952 L: 0.8882

During the early hours of the Asian trading session on Wednesday, the AUD/USD is trying to hang onto the 0.89 level after recently falling from near 0.8950. Despite its strong recovery in September, the Australian dollar has been in a free-fall for a lot of this year. Current range: trading just below 0.8900.

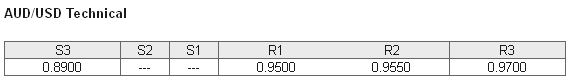

Further levels in both directions:

• Below: 0.8900.

• Above: 0.9500, 0.9550 and 0.9700.

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has moved back below 70% as the Australian dollar has fallen below 0.90 for the first time in three months. The trader sentiment remains in favour of long positions.

Economic Releases

- 09:30 UK BoE MPC minutes released

- 09:30 UK Average Earnings (Oct)

- 09:30 UK Claimant Count Change (Nov)

- 09:30 UK Claimant Count Rate (Nov)

- 09:30 UK ILO Unemployment Rate (Oct)

- 13:30 CA Wholesale Sales (Oct)

- 13:30 US Building Permits (Nov)

- 13:30 US Housing Starts (Sep, Oct & Nov)

- 19:00 US FOMC - Fed Funds Rate (Dec)

- 19:00 US Fed releases Summary of Economic Projections

- 19:30 US Fed Chairman Bernanke holds his last press conference as Chairman following the FOMC meeting on interest rate policy

- EU ECB Governing Council and General Council hold non-rate setting meeting (to 19 Dec)

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI