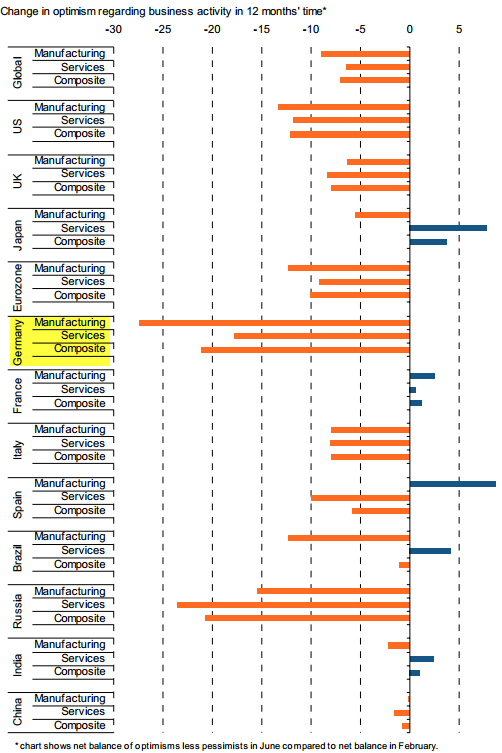

According to the latest Markit Business Outlook Global survey, the Germans, particularly German manufacturers have had significant declines in business optimism compared to other large nations. The diagram below shows changes in business outlook between the months of February and June of 2012.

The size of the decline in optimism is a bit surprising given that the German economy continues to do relatively well. We did see some signs of German economic slowdown showing up in the German PMI numbers. More recently we saw a year-over-year decline in the manufacturing orders as well.

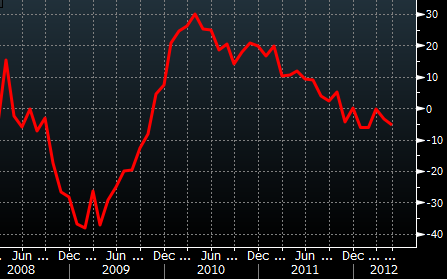

Some of the explanation has to do with exports. German exports to Asia have grown considerably in the last 20 years as can be seen from this diagram. Exports to China in particular have increased sharply. But the EU remains Germany's primary customer. With both China and the EU slowing down, the reasons for the manufacturing pessimism become more clear.

Markit: “June’s survey shows a worrying yet unsurprising drop in business confidence across the German private sector. Manufacturers reported the biggest pull-back in their expectations for the year ahead, and sentiment is now the worst since the recession was in full swing at the start of 2009. While a slowdown in the euro area economy was a 'known known' back in February, it’s how the erstwhile 'known unknowns' have played out in recent months that has caused expectations to drop, namely clearer signs of weakening emerging market export sales and an intensification of the euro crisis in the periphery.”

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.