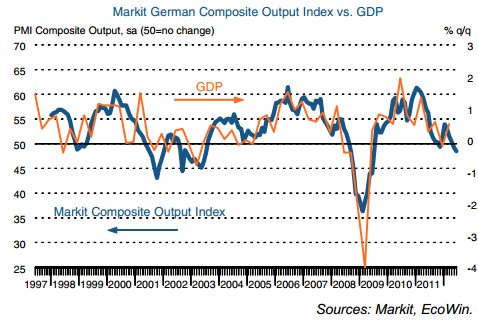

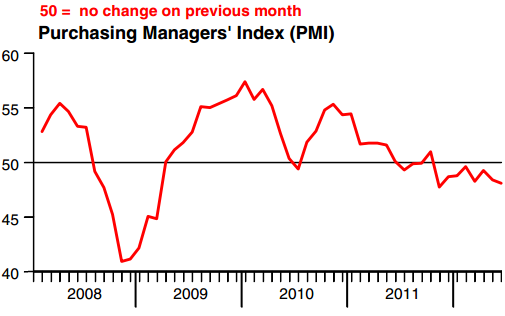

The global slowdown is becoming quite visible among the major economies. The US is still growing, but the latest PMI measure for June came in at 52.9, down from 54 last month. Germany's PMI came in below 50 (indicating contraction), with manufacturing PMI below 45.

The last time German manufacturing PMI was this low was in mid 2009.

And China's PMI is now materially below 50 with a troubling downward trend.

In an addict-style behavior, market participants are hoping these declining PMI numbers will invite additional government stimulus - on top of what has already been put in place.

WSJ: The HSBC initial, or "flash," measure of manufacturing also foreshadowed weakness in the months ahead as its barometer of new manufacturing orders, particularly export orders, showed further declines amid a lingering global economic slowdown.

China has already turned to an array of measures to boost growth, speeding up approvals on big projects, offering tax breaks and extending subsidies to promote consumer spending. A big unanswered question is whether the plethora of actions in the past month or so will be sufficient to boost growth during the second half of the year. If so, it could help strengthen global demand at a time when Europe is in recession and the US is growing slowly.

But at this stage stimulus will likely have temporary and limited effects on growth. Unfortunately all the uncertainties around the eurozone's future will cap investment levels and limit new orders. And given how long it may take to remove that uncertainty, we may be looking at years of slow growth globally.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.