Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

- Industrial production in the UK on track to firm up in today’s report for June

- UK economic growth projected to remain steady in NIESR’s July estimate

- Steady growth will be a sign of the robust nature of the UK economy

- US jobless claims should show the labour market expanding at a solid pace

UK economic data will be in the headlines today with the monthly update on industrial production for June and NIESR’s July estimate of GDP growth. For the US, the weekly release of initial jobless claims is expected to provide more evidence that the labour market’s trend remains healthy.

UK: Industrial Production (0830 GMT) Analysts see a rebound for today’s June report on industrial activity, providing Britain with some upbeat economic news after a former chancellor of the exchequer issued a warning for the macro outlook.

Today's new filings for jobless benefits should offer more bullish news for US employment and there is even a risk of labour shortages constraining growth.

Alistair Darling told BBC on Wednesday that “alarm bells are ringing for the UK economy,” pointing to slowing growth at a time of rising consumer debt. “When interest rates go up, and they will go up, if not this year then certainly next year, and suddenly people find they are going to be paying more in their monthly payments, that's when you need to watch out.”

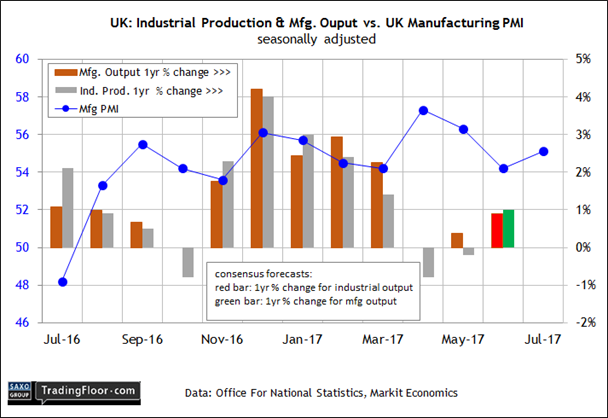

Today’s data, however, is expected to provide some relief. Econoday.com’s consensus forecast calls for a 0.4% rise in production, up from the 0.1% slide in May. The year-over-year change is also headed higher, analysts say, reaching a 1.0% advance – the fastest pace since March.

Survey data for the manufacturing sector supports the upbeat estimates. Although the UK Manufacturing PMI slipped in June to a three-month low, the July release edged higher.

“UK manufacturing started the third quarter on a solid footing,” an analyst at IHS Markit said last week. “The headline PMI signalled a growth acceleration for the first time in three months during July, as new order intakes were boosted by a near survey-record increase in new export business.”

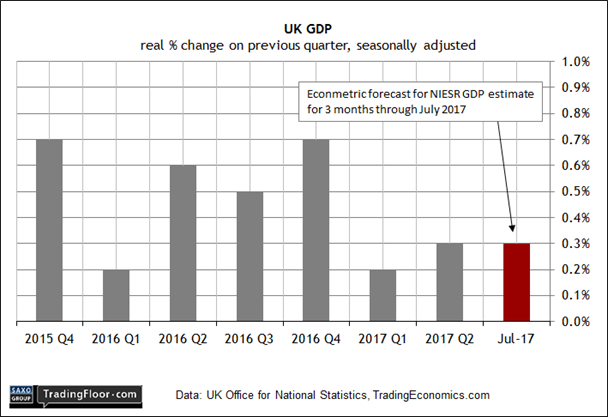

UK: NIESR GDP Estimate (1200 GMT) Economic growth has decelerated in recent quarters, but today’s release is expected to show that output is stabilising.

Economic activity grew at a modest 0.3% in the official second-quarter GDP report. That’s fractionally above the 0.2% pace in Q1, but well below the 0.5%-to-0.7% readings in the last three quarters of 2016.

Today’s estimate for the three-month change through July from the National Institute of Economic and Social Research (NIESR) offers a preview of third-quarter figures. TradingEconomics.com’s econometric estimate calls for a 0.3% rise. That’s still below the 0.6% long-run trend, according to NIESR. But a stable trend will be greeted favourably at a time of rising uncertainty for the UK, in part due to ongoing Brexit negotiations with the European Union.

“One of the things that has surprised economists and the markets over the past year is the robustness of the UK economy in the wake of the [Brexit] referendum result,” the CEO of Lloyds (LON:LLOY) Bank said this week.

Today’s NIESR data will help the crowd decide if that observation is still relevant -- or if Alistair Darling's warning deserves more consideration.

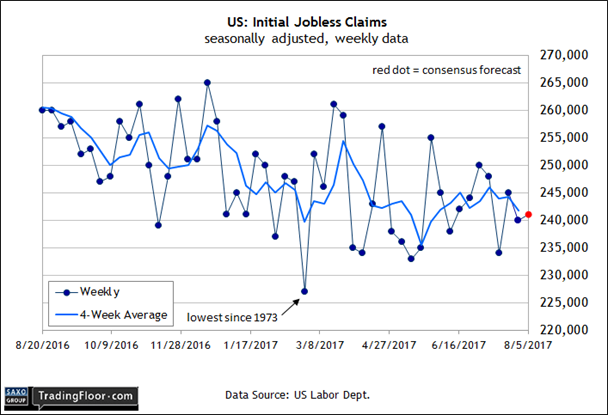

US: Initial Jobless Claims (1230 GMT) Job openings surged in June, rising more than expected to a record level, based on a government data set that begins in 2000. The news reinforces last week’s upbeat numbers on payrolls for July.

There’s a dark side, however, to the bullish data on openings, according to the chief economist at MUFG in New York.

“Companies are running out of workers to hire to do the job or even train to do the work, and this is a ticking time bomb for economic growth," said Chris Rupkey. Meantime, the latest rise in openings suggests that the odds are higher than previously expected for a rate hike by the Federal Reserve at its September monetary policy meeting, he added.

Today’s weekly release on new filings for unemployment benefits is expected to offer another round of bullish news for the payrolls outlook. Claims are on track for a slight rise of 1,000 to a seasonally adjusted 241,000. But that’s still close to the 227,000 mark from February, a multi-decade low. If the dismal scientists are right, jobless claims will offer fresh confirmation that macro risk remains low from the vantage point of the labour market.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.