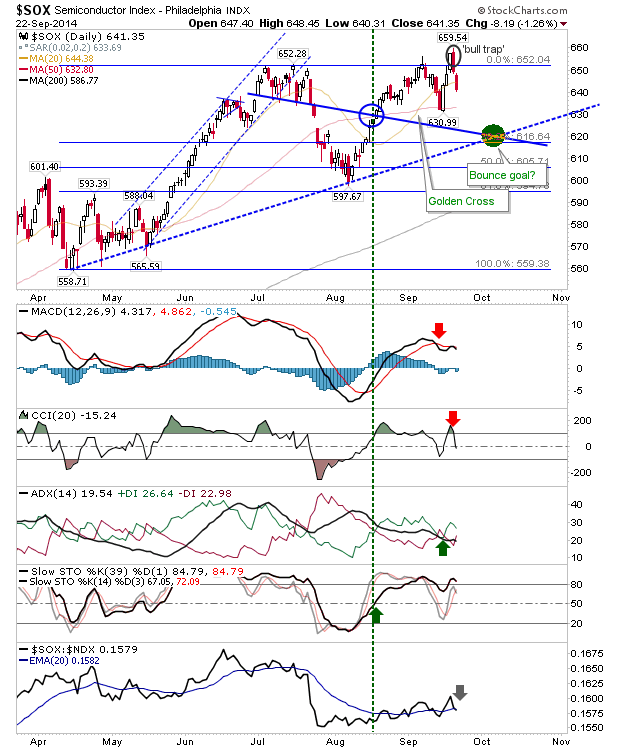

The failed breakout in the Semiconductor Index expanded with another loss above 1%. Monday's loss took it below the 20-day MA, kept the MACD 'sell' trigger in play and generated a CCI 'sell' trigger.

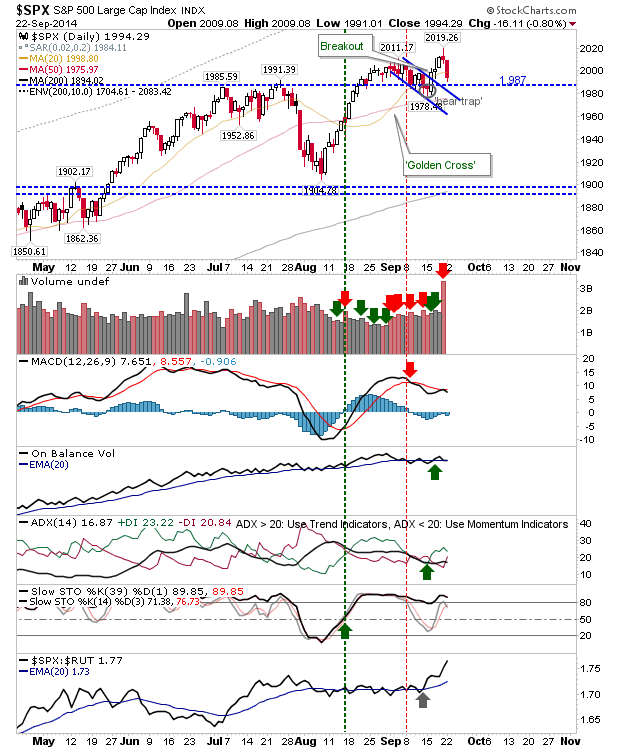

Other indices similarly pulled away from Friday's sell off, but not enough to break support. The S&P 500 remained above 1,987 and will see a test tomorrow. Technicals are mixed: the Directional Movement System is bullish, but the MACD has been bearish for most of September.

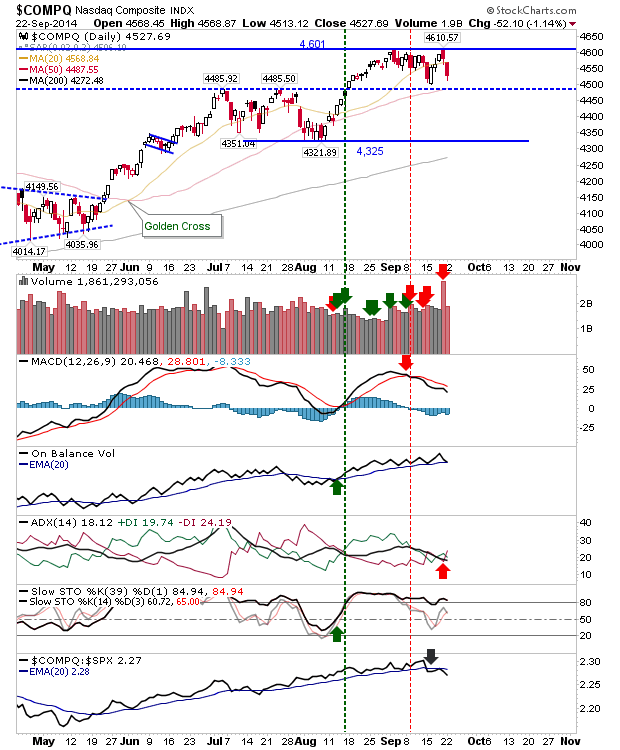

The NASDAQ didn't 'bull trap', but it's heading to a combined test of 4,485 trading range and the 20-day MA.

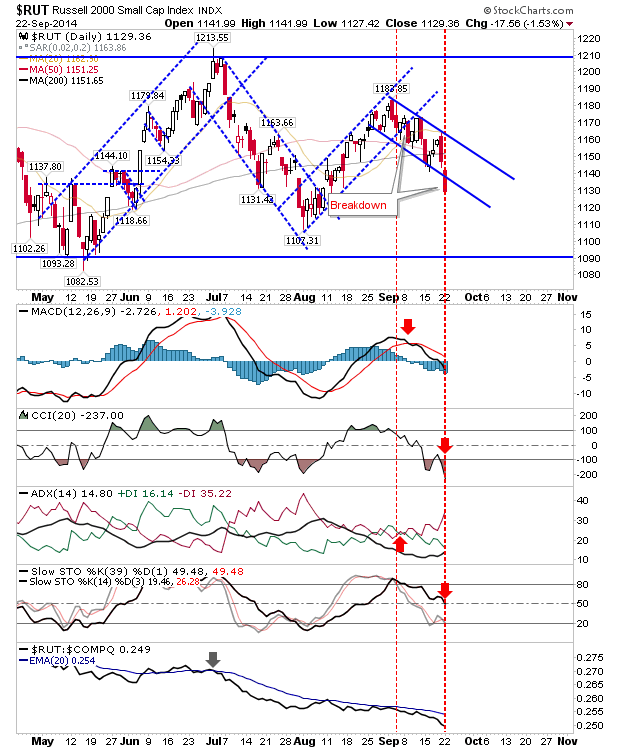

Meanwhile, the Russell 2000 broke below channel support in an acceleration of the losses from August's highs. A move to the May 1,090 swing low is the next key target. The July swing low may/may not play a role in the move down.

Tomorrow may see support tests and offer rebound opportunities. Best of these plays could be the Nasdaq given the convergence of the 50-day MA and 4,485 key support. If bears take control of morning action, then a Semiconductor push to its 50-day MA is a better option as a short/long switch.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.