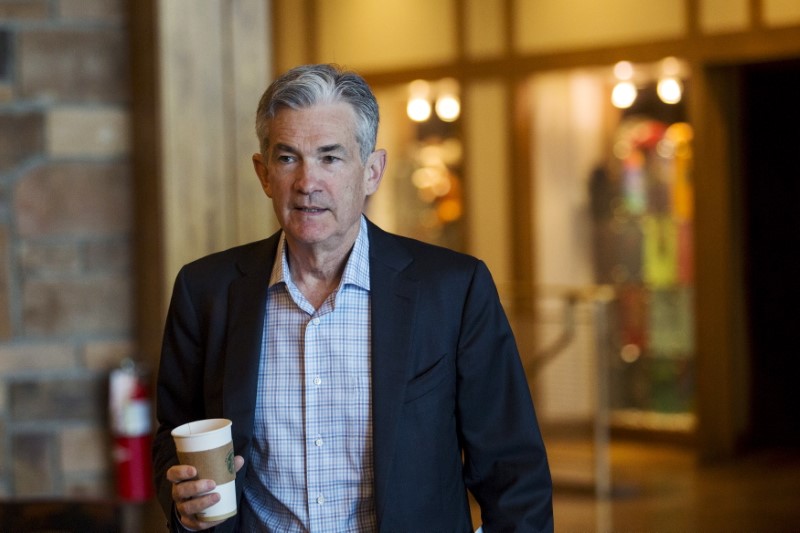

MORGANTOWN, W.Va. (Reuters) - The impact of the new Trump administration's effect on the economy remains too uncertain for the U.S. Federal Reserve to react or begin recasting its outlook, Fed Governor Jerome Powell said on Tuesday.

Asked about the collapse of the healthcare bill last week, Powell said that uncertainty about "the scope, the timing and the contents" of President Donald Trump's policies were making it difficult for Fed policymakers to assess what they might mean.

"It is difficult to incorporate effects from policy when it is so uncertain what the policy may be. So I don't incorporate any effects for now," Powell said. "Until things become clearer, it is difficult to assess."

Since Trump's election, Fed officials have debated how his campaign promises may change an economy many policymakers feel is on a sturdy course.

Depending on how those policies are designed and when and if they are approved, the programs Trump promised during the campaign - tax cuts, massive infrastructure spending, tough trade rules, tighter limits on immigration - could boost growth, lead to higher inflation, or throw the global economy into a trade war.

The collapse of the healthcare overhaul effort on Friday has, if anything, made the U.S. central bank's job harder as it tries to tease out what set of policies may make it through Congress.

"We are just going to have to wait and see," Powell said in remarks to reporters after a speech at West Virginia University in Morgantown.

Overall, Powell said he felt the economy was on a solid path that warranted continued interest rate increases this year. The Fed raised rates in March, and a majority of the central bank's policymakers foresee at least two more increases this year.

"It is appropriate we stay on this path to gradually raise interest rates," Powell said. "March was a good time. ... There will be scope for more."