Trump announces 50% tariff on copper, effective August 1

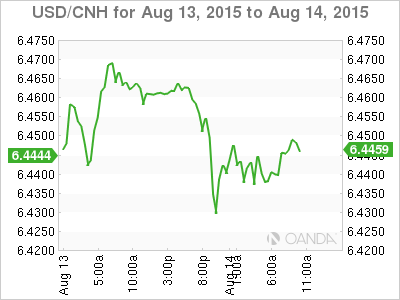

The yuan halted a three-day slide after China’s central bank raised its reference rate for the first time since Tuesday’s devaluation and said it will intervene to prevent excessive swings.

The onshore spot rate was little changed at 6.4003 per dollar as of 12:56 p.m. in Shanghai, after falling 3 percent this week. The People’s Bank of China said Thursday there’s no basis for depreciation to persist and that it will step in to curb large fluctuations. It followed up with a 0.05 percent strengthening of its daily fixing on Friday, after three cuts of more than 1 percent each.

China’s first major devaluation since 1994 surprised global investors and fueled concern that authorities are struggling to combat a slowdown in the world’s second-largest economy. Policy makers are trying to balance the need for financial stability against a desire for stronger exports and the yuan’s inclusion in the International Monetary Fund’s basket of reserve currencies.

“The PBOC sent its signal and people understand it’ll be very difficult to go against the PBOC’s will,” said Ken Peng, a Hong Kong-based strategist at Citigroup (NYSE:C), the world’s biggest currency trader. “The central bank will frequently intervene in the foreign-exchange market in the next three months because it needs to ensure the yuan is stable.”

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI