European markets opened slightly higher on Thursday but I’m not expecting a particularly calm session after panic spread across the markets on Wednesday.

It seems everyone is an expert in yield curve inversions these days. Apparently a trade war, economic slowdown and Brexit, among other things, are not reason to panic but the moment the 10-year yield drops below the 2-year, all hell breaks loose.

I’m in no way playing down the risk of recession, the data has been warning about the risks for some time and equity markets have been in denial as they’ve continued to scale new highs. It’s often said that the bond market is a step ahead which is why the panic has set in but I do believe we read too much into trends at times at the 2-10 year fear certainly falls into this bracket.

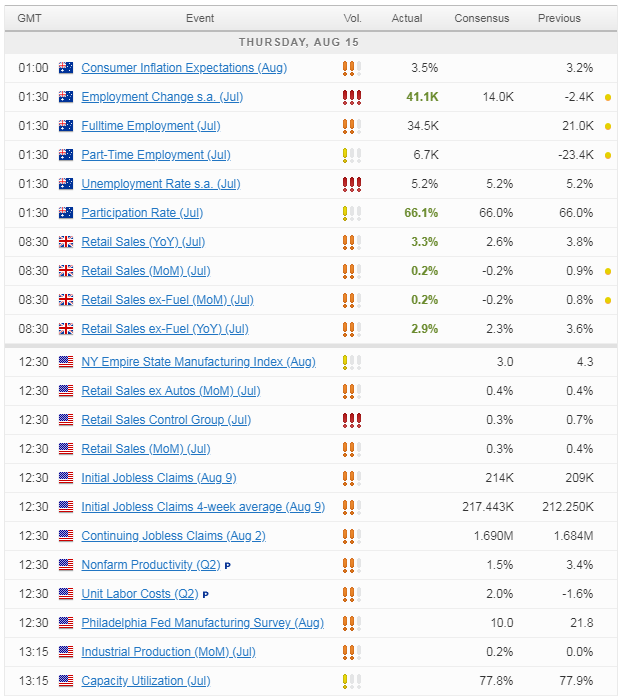

Markets look a little steadier at the start of trading today but days like today can be like the good old British weather, sunny in the morning and storms by lunch time. In these markets, I wouldn’t be surprised to see a rollercoaster of a day and there’s plenty of data coming throughout to provide the catalyst.

UK retail sales this morning will obviously be of interest, following the contraction in the second quarter, and this will be followed by a whole host of releases from the US later on to really shake things up. Also expect plenty more on the trade war and yield curves, which means much attention on the President’s Twitter account.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.