BofA warns Fed risks policy mistake with early rate cuts

Several readers asked me to comment on the possibility of a yield cure inversion. An inversion occurs when shorter term rates have a higher yield than longer dated rates. Typically this is a strong recession warning.

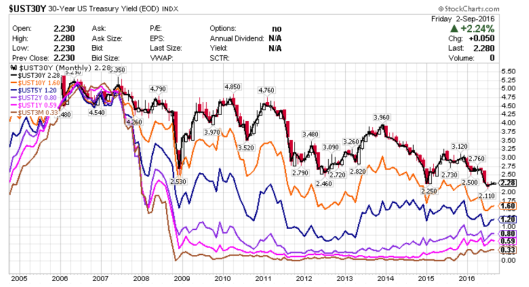

Let’s start with a look at a couple of yield curve charts.

Yield Curve Monthly

Judging from the above chart, I see little reason to believe there will be any inversion at the long end of the curve or between the long end of the curve and the short end of the curve. Although yield curve inversions signal recessions, yields are too low for the curve to invert.

Yield Curve 3-Months to U.S. 5-Years

Curiously, there was a very tiny inversion between between 6-Months and 1-Year on February 2. On that date, the yield on one year Treasuries was less than the yield on 6-month Treasuries. The amount was not even a full basis point (0.01 percentage points). The above chart shows they touched.

If the Fed hikes twice, I would expect portions of the short end of the curve to invert.

Yield Curve Spreads

- 3-month to 6-month spread: 12 basis points

- 6-month to 1-year spread: 14 basis points

- 1-year to 2-year spread: 21 basis points

- 2-year to 3-year spread: 12 basis points

- 3-year to 5-year spread: 28 basis points

Even one hike of 25 basis points could cause an inversion. If the Fed does hike twice, I would expect multiple inversions. The likely places are the 6-month to 1-year spread and the 2-year to 3-year spread.

Which stocks should you consider in your very next trade?

Successful investors know to check multiple angles before making their move. InvestingPro's three powerful features work together to give you that edge:

ProPicks AI runs 80+ stock-picking strategies, including Tech Titans, which doubled the S&P 500's performance in just 18 months!

Fair Value combines 17 proven valuation models to help you spot overpriced stocks and undervalued gems.

And WarrenAI delivers instant insights on any stock. Ask questions, get vetted answers backed by real-time data (unlike ChatGPT).

Our subscribers use all three to identify stocks before double-digit gains and avoid costly mistakes.

But with 50% during our Summer Sale, even if you only use one of these features the value pays for itself. Sale ends soon—don't wait until prices go back up.

Save 50% while you can