Fundamental Forecast for Japanese Yen: Bullish

- Yen May Turn Higher Amid Year-End Carry Trade Liquidation

- Upbeat US Data May Fuel Risk Aversion, Helping to Power Yen Bounce

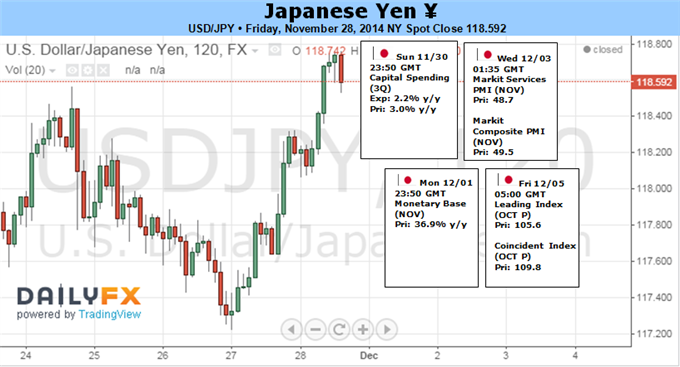

The markets continue to seem relatively sanguine in their outlook on Japanese domestic developments with the December 14 snap election drawing closer (as we discussed last week). That is likely to keep external factors at the forefront in the near term, with seasonal considerations becoming ever more important as the looming end of the calendar year alters capital flows.

While risk appetite flourished in 2014, investors are almost certainly questioning that trend’s continuity in the year ahead as consensus forecasts calling for some degree of Fed stimulus withdrawal become increasingly entrenched. That may fuel a desire to book profits on risk-sensitive exposure as the year-end holiday cycle gets underway, securing yearly performance numbers ahead of what might be tougher times ahead.

In the FX space such, this translates into liquidation of carry trades, many of which are financed in terms of the perennially low-yielding Japanese unit. A broad unwinding this exposure would translate into a wave of short-covering on anti-Yen positions, putting substantial upward pressure on the currency. Thin inter-holiday liquidity conditions may amplify volatility, making for particularly sharp moves against prevalent trends and vaulting JPY swiftly higher from recently-established six-year lows.

US economic news-flow may likewise encourage this dynamic. A slew of high-profile releases are due to cross the wires including manufacturing- and service-sector ISM figures, the Fed’s Beige Book survey of regional economic conditions, and the always intensely followed US Employment report. Outcome expectations point to improvements in most areas (albeit with some soft spots). If these prove robust, this may fuel speculation that Janet Yellen and company will move faster to lift rates than is currently priced in, encouraging the push toward liquidation and accelerating Yen gains.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.