The SPX has one more support level to break through, and that is the weekly mid-cycle support at 1194.37. Once that is accomplished, the next levels for is the cycle bottom support at 1014.11. The support also corresponds with the bottom trendline of a massive Orthodox Broadening Top formation. If the SPX crosses that trendline in the next day or so, the average Broadening Top target is 780.00, corresponding. Nicely with the head and shoulders minimum target 778 that may be triggered when the SPX declines below 1074.77.

Believe it or not, the current declining cycle should not find a bottom until December 29. Suffice it to say that the SPX is entering a crash zone for the year end.

The analysts at Bank of America give the SPX a 50% chance of reaching 950-935 sometime next year. Let's see who is correct. I am not sure I want them on my side.

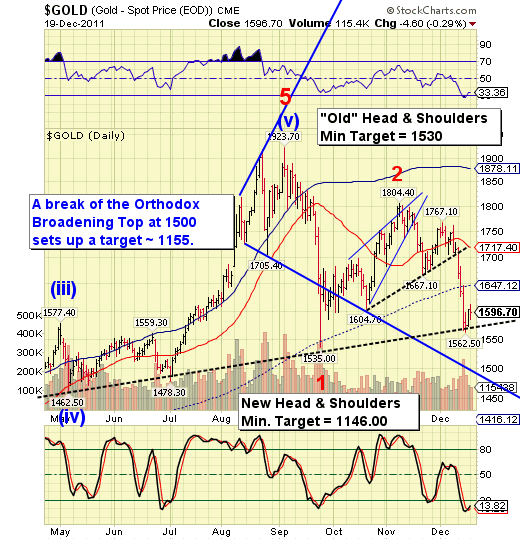

Many pundits are trying a line in the sand for gold around 1560.00, saying that gold is still in an uptrend which, technically, may be correct. However, the cycles model definition of the uptrend was to remain above 1647.12. Which is correct? It doesn't take a rocket scientist to figure out that this so-called trendline that most analysts are pointing to is also the massive head and shoulders neckline. Is broken, the “uptrend” is lost.

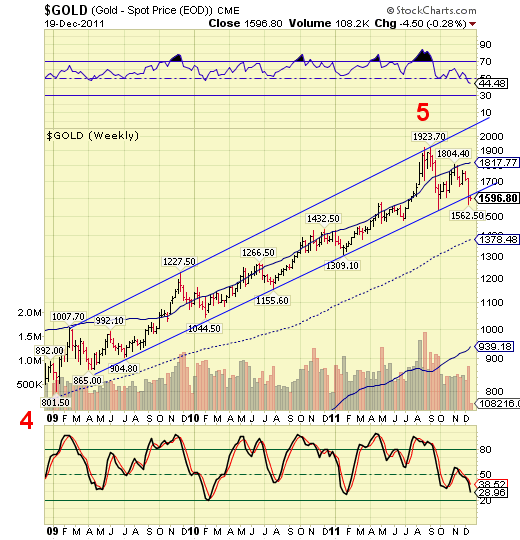

I always try to maintain multiple points of view and the weekly chart shows that the uptrend is already broken in gold. It has been retesting it trendline today. It is rare for an uptrend be broken on a weekly chart before daily chart. There are no tricks here, however. Long-term uptrend is now broken in gold.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

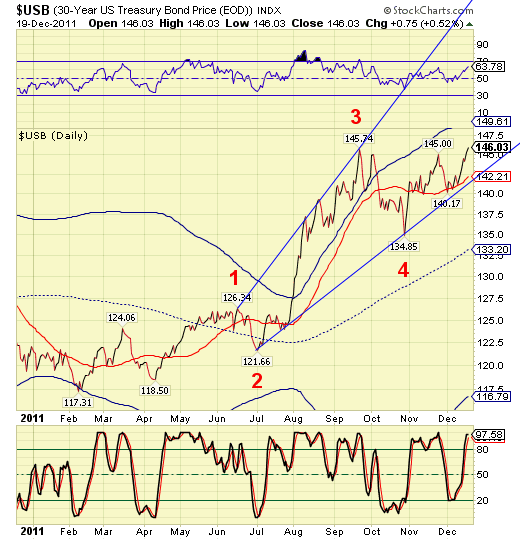

The USD just staged a breakout above its all-time high. The implication here is enormous. The broadening wedge formation implies that USB could go as high as 200.00. What we're looking at here is a potentially unprecedented buying panic in bonds. The trick now is to know when to get off this roller coaster.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.