U.S. stocks index futures were initially climbing on optimism that U.S. President Trump will delay additional tariffs and that the world’s two largest economies will have a reset in trade talks. Last month, talks were close to a deal after both sides seemed to be agree on Chinese purchases of U.S. goods, intellectual property rules and market access. It all fell apart after China backed out of making changes to their law and that was a deal breaker for Trump as he wants to see structural reform in China.

Just as important for China is the optics of how a deal is reached. They do not want to appear weak and succumbing to U.S. pressure. U.S. officials are trying to temper expectations from becoming too optimistic, but with stocks near record territory, it appears markets are fairly convinced some good will come out of Osaka this weekend.

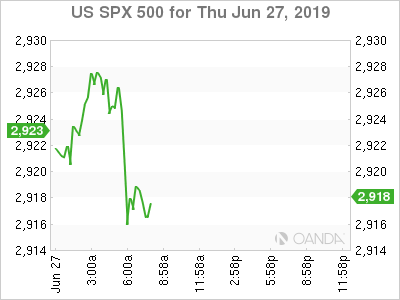

Equities took a small reversal after the Wall Street Journal reported “Beijing is insisting U.S. remove its ban on the sale of U.S. technology to Chinese telecommunications giant Huawei Technologies Co. Beijing also wants the U.S. to lift all punitive tariffs and drop efforts to get China to buy even more U.S. exports than Beijing said it would when the two leaders last met in December.” It seems like this could easily get shot down by President Trump and U.S. indexes returned near the lows of the day.

Iran

European governments do not want Iran to abandon the 2015 nuclear deal and seem prepared to offer a credit line to help a special mechanism to enable trade with the West. Iran’s economy has been crippled by U.S. sanctions and the resumption of making weapons-grade material next month has motivated Europe to provide Tehran with an offer. If Iran violates the old agreement, the EU will threaten to remove this barter-like solution that would alleviate a lot of economic pain in the short-term.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI