Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

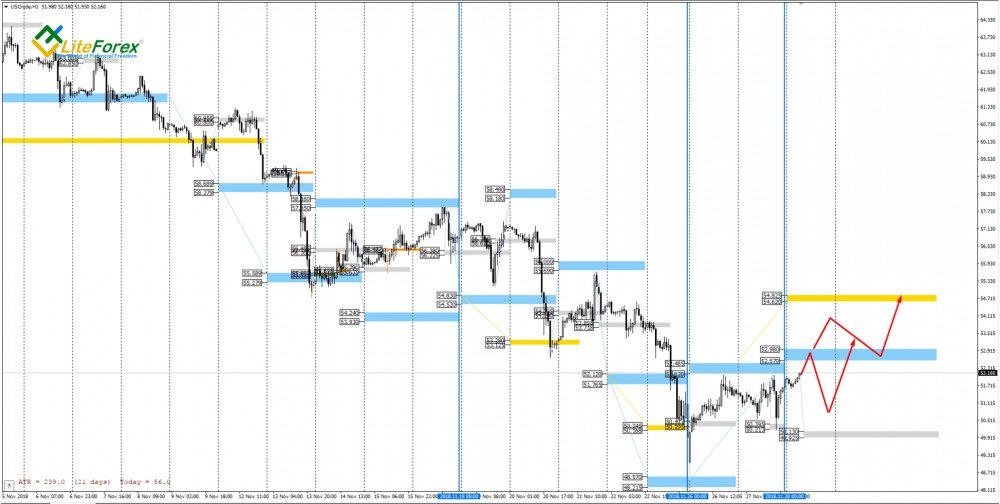

Oil margin requirements are changed at the Chicago Mercantile Exchange. Maintenance margin for Crude Oil futures is 4100 USD since today. All zones that haven’t been broken out/reached by the price must be rearranged.

In the longer time frame, oil price is being corrected up in the middle-term downtrend. The key resistance is now at [52.98 – 52.57]. The sell target is in the zone of [47.89 – 47.48].

If oil buyers break through the resistance today or tomorrow, we shall buy oil in the middle-term on the next trading day.

The target for short-term buys at the key support [50.26 – 50.08] has been reached at the Asian session today. The instrument price continues rising. If the US session closes above 52.98 – 52.57, the next target will be Gold Zone [54.82 – 54.62].

The new Intermediary Zone can be drawn down from the current high. It will be at [50.13 – 49.92]. But, if the high is broken through, IZ should be rearranged.

WTI trading tips for today:

Buy according to the pattern in Intermediary Zone [50.13 – 49.92]. TakeProfit: Target (NYSE:TGT) Zone [52.98 – 52.57]. StopLoss: according to the pattern rules.

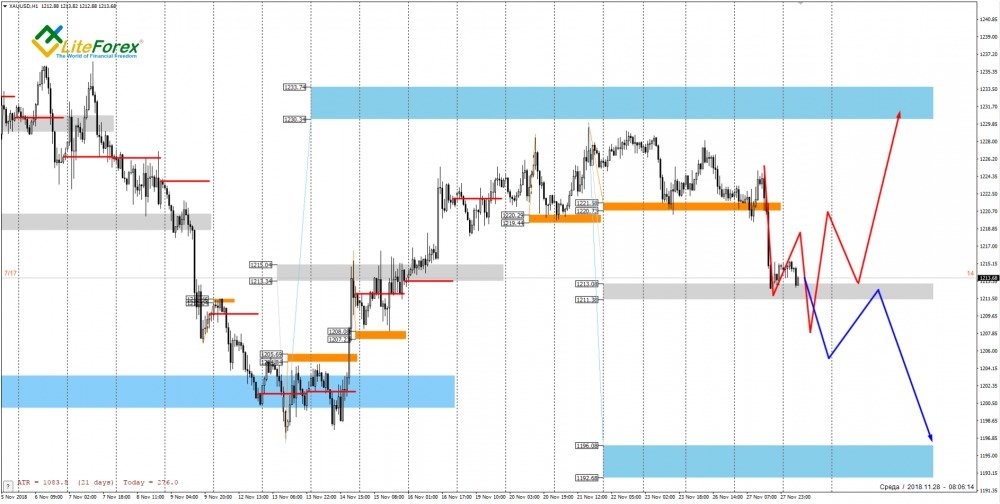

Gold is trading down in the middle-term. The first downward target is November’s low, the second - Target Zone 2 [1175.4 – 1172.0]. The downward scenario will be canceled if the key resistance of the trend [1233.7 – 1230.3] is broken out.

Let’s see the chart in the shorter time frame. The key support to the short-term trend [1213.0 – 1211.3] is being tested. Until the zone is broken out, it will be relevant to buy with the target to renew the high of November 21.

If IZ is broken out at the US session with consolidation, the short-term trend will reverse downwards. In this case, we shall look for sales down to the lower Target Zone [1196.0 – 1192.6].

XAU/USD trading tips for today:

Buy according to the pattern in Intermediary Zone [1213.0 – 1211.3]. Take Profit: Target Zone [1233.7 – 1230.3]. Stop Loss: according to the pattern rules.

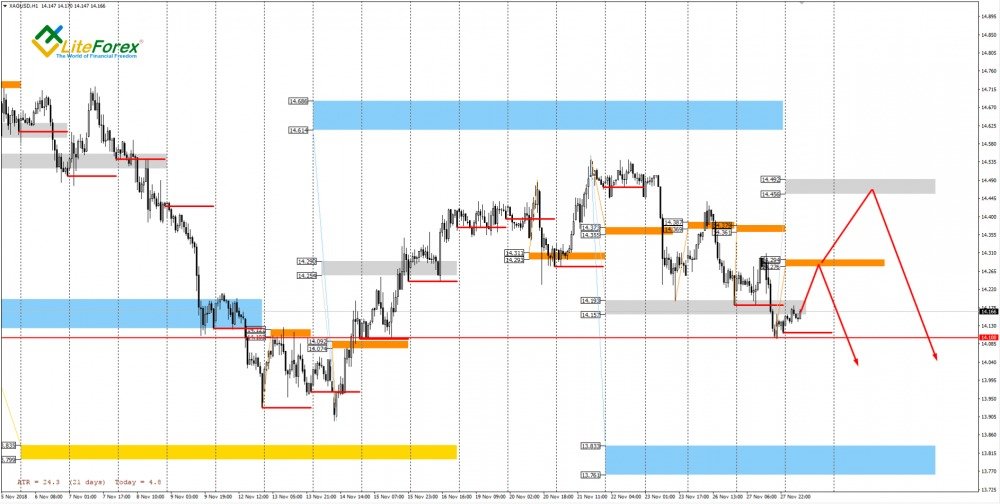

Silver sellers broke out level 14.22. The sell pattern is complete. I recommend enter/hold on short trades with the target at 13.90 + Target Zone 5 [13.67 – 13.59]. It is the trading advice for middle-term traders.

The short-term trend reversed downwards as Intermediary Zone [14.19 – 14.15] was broken out yesterday. Today, you may expect a correction and look for silver sells in Additional Zone [14.29 – 14.27], and then in Intermediary Zone [14.49 – 14.45]. The latter is the key resistance of the trend.

Sell target will be in Target Zone [13.83 – 13.76].

XAG/USD trading tips for today:

- Sell according to the pattern in Additional Zone [14.29 – 14.27]. Take Profit: 14.10, Target Zone [13.83 – 13.76]. Stop Loss: according to the pattern rules.

- Sell according to the pattern in Intermediary Zone [14.49 – 14.45]. Take Profit: 14.10, Target Zone [13.83 – 13.76]. Stop Loss: according to the pattern rules.

IZ - Intermediary Zone: responsible for the price momentum reversing.

TZ - Target Zone: a zone that is 75% likely to be reached after IZ breakout.

GZ - Gold Zone: zone in the medium-term momentum.

All zones are calculated based on the average daily price of the instrument and margin requirements of the futures.