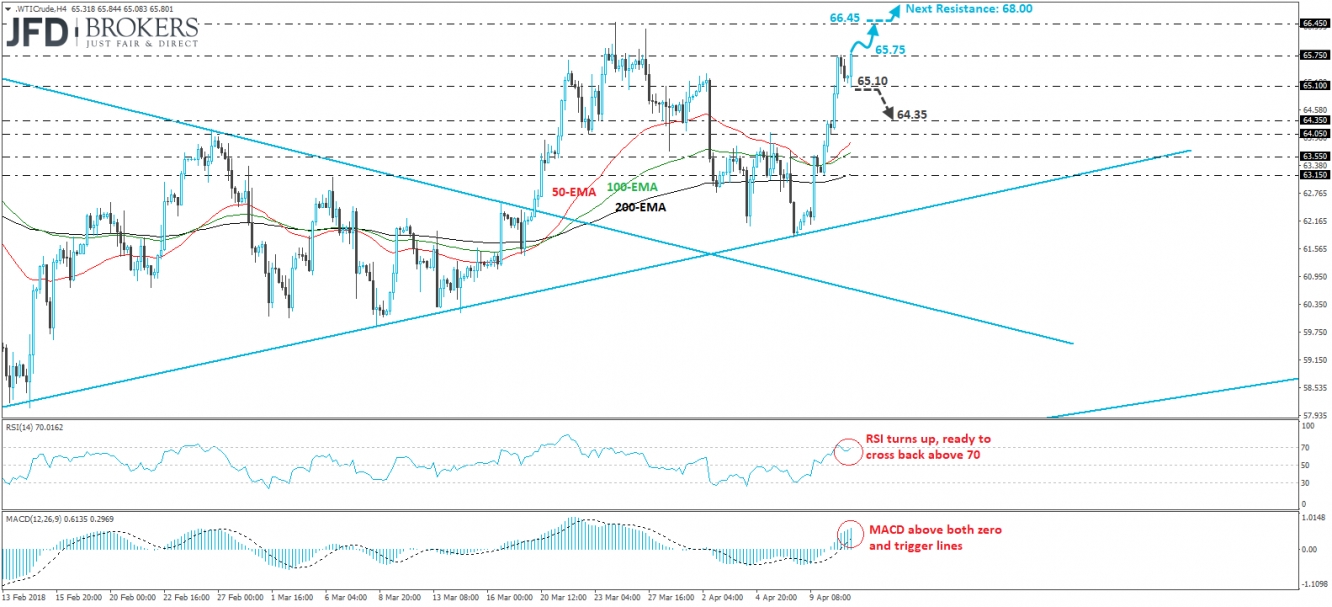

WTI edged north during the European morning Wednesday after it hit support near the 65.10 level, to break briefly above the yesterday’s high of 65.75. The latest rally in black gold came after the price tested the medium-term upside support line drawn from the low of the 11th of September, while the catalysts behind the move may have been the ease of concerns around the US-China trade conflict, as well as fears over supply disruptions in Middle East due to the prospect of US military action in Syria. The strong recovery came even as US production continues to expand, and even after the Energy Information Administration (EIA) revised up its US production estimates in its monthly energy outlook report, that was published yesterday.

Having in mind that the rally came after testing the aforementioned key upside support line, we believe that the outlook remains positive. We expect the break above the 65.75 barrier to pave the way towards the critical resistance territory of 66.45, marked by the peaks of the 26th of March and 25th of January.

That said though, we would like to see a clear close above that territory before we get more confident on the continuation of the prevailing uptrend. Such a break would confirm a forthcoming higher high on the daily chart and may initially see scope for extensions towards the 68.00 area, marked by the peak of the 4th of December 2014.

Looking at our short-term momentum indicators, we see that the RSI has turned up again and now looks ready to cross back above its 70 line, while the MACD stands above both its zero and trigger lines. These indicators detect upside speed and support further the case for WTI to continue trading north for a while more, at least for a test near 66.45.

On the downside, a dip back below the 65.10 level could signal the beginning of a corrective move, which could first aim for our next support of 64.35. However, the price would still be trading above the upside support line drawn from the low of the 11th of September, and thus we would still consider the medium-term outlook to be cautiously positive.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI