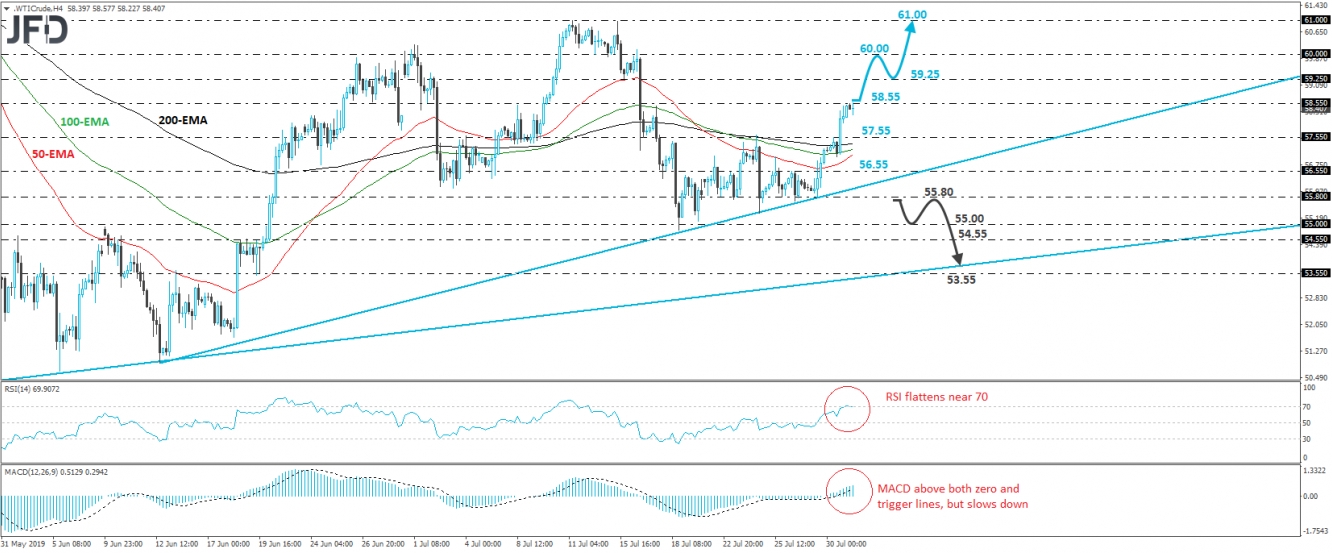

WTI has been in a recovery mode since Monday, when it hit the upside support line drawn from the low of June 12th. Yesterday, the price managed to climb above the resistance (now turned into support) barrier of 57.55, and today, it stopped at around 58.55. Having all these technical signs in mind, we believe that the near-term picture is somewhat positive at the moment.

We believe that a move above 58.55 may initially aim for the inside swing low of July 15th, at 59.25, the break of which could extend the recovery towards the psychological zone of 60.00, which is slightly below the peak of July 16th, and it is also marked by the inside swing low of July 12th. If that hurdle is not able to stop the rally either, then we may see the bulls putting the 61.00 territory on their radars. That zone acted as a strong resistance on July 11th and 15th.

Taking a look at our short-term oscillators, we see that the RSI moved higher but flattened near its 70 line, while the MACD, although above both its zero and trigger lines, has started to slow as well. Both indicators detect positive momentum, but their slowdown suggests that a small corrective setback may occur before the bulls decide to take the reins again.

In order to abandon the bullish case, at least in the short run, we would like to see a decisive dip below 55.80. Such a move would bring the rate below the pre-discussed upside line and may initially pave the way for the 55.00 zone, which is slightly above the low of July 18th and marginally below the low of the day after. If that area does not hold either, then we would monitor the 54.55 barrier, the break of which may allow the slide to continue towards another upside line, which is drawn from the low of December 26th, or towards the 53.55 obstacle, near the low of June 19th.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI