Bitcoin price today: inks new record high near $119k as ETF inflows surge

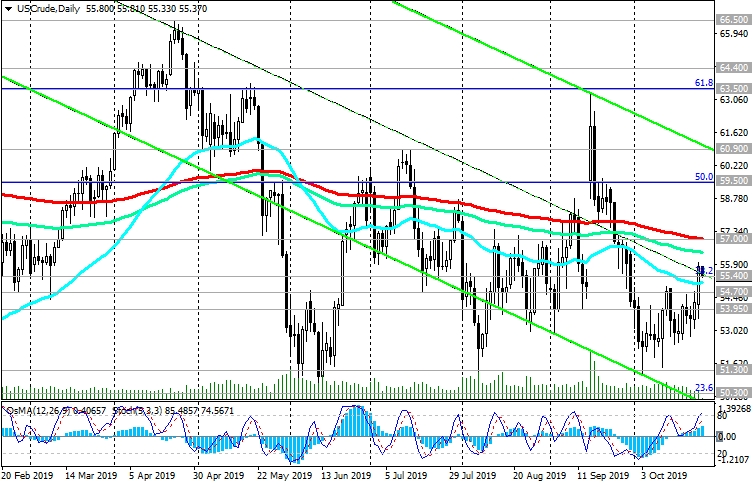

In the middle of last month, the price of WTI crude oil rose sharply, approaching a strong resistance level of 63.50 (Fibonacci level 61.8% of the upward correction to the fall from the highs of the last few years near 76.80 to the support level near 42.15). The sharp rise in oil prices was facilitated by terrorist attacks on oil refineries in Saudi Arabia.

However, the price could not break through this resistance level and subsequently fell, returning to the zone below the key level of 57.00 (ЕМА144, ЕМА200 on the daily and weekly charts).

At the beginning of the European session, WTI crude oil is trading near 55.40 mark, through which the support level (Fibonacci 38.2%) passes, receiving support from yesterday's data on US oil reserves.

Further growth and the breakdown of the resistance level of 57.00 will strengthen the bullish momentum and direct the price to the resistance level of 60.90 (July highs and the upper border of the descending channel on the daily chart) and further to the levels of 63.50, 64.40.

In an alternative scenario, the signal for the resumption of sales will be a breakdown of the support level of 54.70 (ЕМА200 on the 4-hour chart).

So far, a negative impulse prevails. Below the resistance level of 57.00, short positions remain preferred, while the current price increase should be considered corrective.

Now, oil market participants will follow the publication on Friday (at 17:00 GMT) of the weekly report of the American oilfield services company Baker Hughes on the number of active drilling rigs in the United States. Previous reports indicated a decrease in the number of active oil platforms in the United States (to 713 units at the moment). If the report again indicates a decrease in the number of such installations, then this may give a short-term positive impetus to prices.

Today, the attention of participants in financial markets will be focused at a meeting of the ECB. The decision on rates will be published at 11:45 (GMT), and the ECB press conference will begin at 12:30. Interest rates are likely to remain the same. However, the ECB's propensity to further soften its monetary policy may cause an increase in stock indices and quotes for commodities, including oil.

Support Levels: 55.40, 54.70, 53.95, 53.00, 52.00, 51.30, 50.30, 49.00, 42.15

Resistance Levels: 57.00, 59.50, 60.90, 63.50, 64.40, 66.50

Trading Recommendations

Sell Stop 54.60. Stop-Loss 56.10. Take-Profit 53.95, 53.00, 52.00, 51.30, 50.30, 49.00, 42.15

Buy Stop 56.10. Stop-Loss 54.60. Take-Profit 57.00, 59.50, 60.90

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.