Against the background of increased geopolitical risks with oil supplies from a number of oil-producing countries, oil quotes rose sharply last week.

Even the US Department of Energy reports about a significant increase in oil reserves in the country last week, as well as a report by the American oilfield services company Baker Hughes, indicating an increase in active oil platforms in the United States to 831 units, could not stop the rise of the oil prices. Risks of oil supplies from Libya, where civil war rages, were added to the risks of restricting the supply of oil from Iran and Venezuela.

Investor expectations of a positive outcome of trade negotiations between the United States and China also contributed to the rise in oil prices. Last Friday, US President Donald Trump said that a compromise is possible with China to get out of the trade conflict.

Thus, last week, oil prices reached their next annual highs.

On Friday, the price of Brent crude oil rose 1.7% to $70.90 a barrel, while WTI oil rose on Friday to $63.15 a barrel.

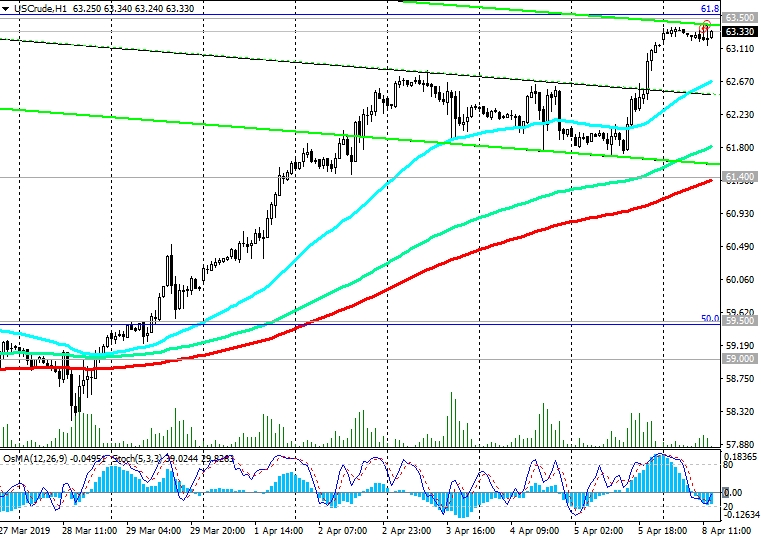

Despite the fact that on Monday the growth of prices stopped, a further increase in oil prices is likely.

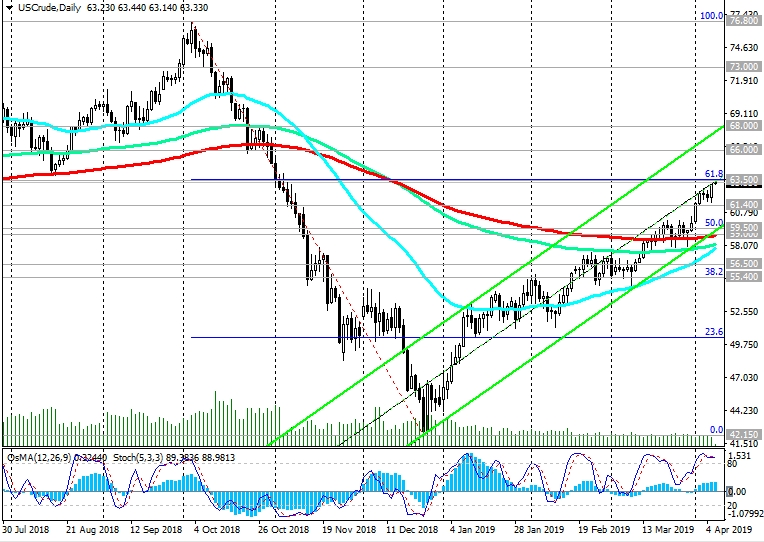

The breakdown of the local resistance level of 63.50 (Fibonacci level of 61.8%) will create the prerequisites for further growth in the price of WTI crude oil.

Above key support levels of 59.00 (ЕМА200 on the daily chart), 59.50 (Fibonacci 50% of the upward correction to a fall from the highs of the past few years near 76.80 to the support level near 42.14) the long-term bullish trend remains.

Only a breakdown of support levels of 56.50 (ЕМА200 on the weekly chart), 55.40 (Fibonacci 38.2%) will revive the bearish trend.

While positive dynamics prevail, long positions are preferable.

- Support Levels: 61.40, 59.50, 59.00, 56.50, 55.40

- Resistance Levels: 63.50, 65.00, 66.00, 68.00

Trading scenarios

Sell Stop 61.30. Stop Loss 63.60. Take-Profit 61.00, 59.50, 59.00, 56.50, 55.40

Buy Stop 63.60. Stop Loss 61.30. Take-Profit 64.00, 65.00, 66.00, 68.00, 73.00

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.