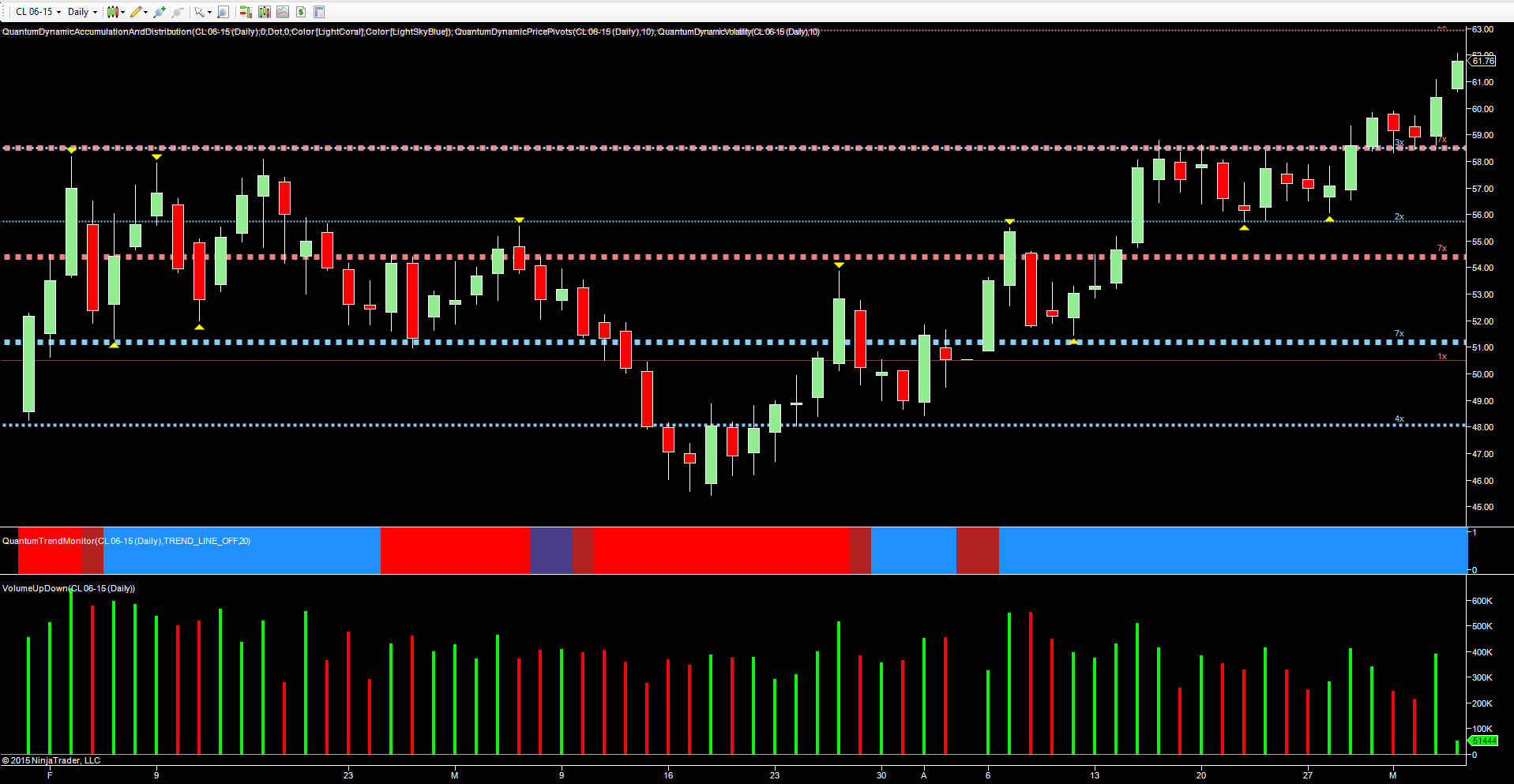

It was another positive day yesterday for crude oil which continued its recent bullish momentum, moving firmly through the $60 per barrel price point to close at $60.40 per barrel on the daily oil chart. This positive sentiment for oil has continued on Globex overnight and into the morning session with oil prices trading higher again at $61.87 per barrel at the time of writing.

Yesterday’s move higher was accompanied by solid volume, confirming the price action which closed with a wide spread up candle while holding the platform of support which is now firmly in place below at $58.50. This has provided the springboard for the move higher. Whilst the technical picture remains bullish, the fundamentals too are now helping to take oil prices higher, with weakness in the US dollar, a slowdown in output from Libya coupled with news that Saudi Arabia has increased its official selling price. These factors are all providing additional momentum.

Today sees the release of the latest oil inventory stats from the Texas Cushing hub, with the forecast for another build, albeit modest by recent standards. Last week saw the downward trend in oversupply continue. Should we see this again later today, then oil is likely to move higher, building on the double bottom now in place on the weekly chart.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.