Trump slaps 30% tariffs on EU, Mexico

WTI Crude Oil Non-Commercial Positions:

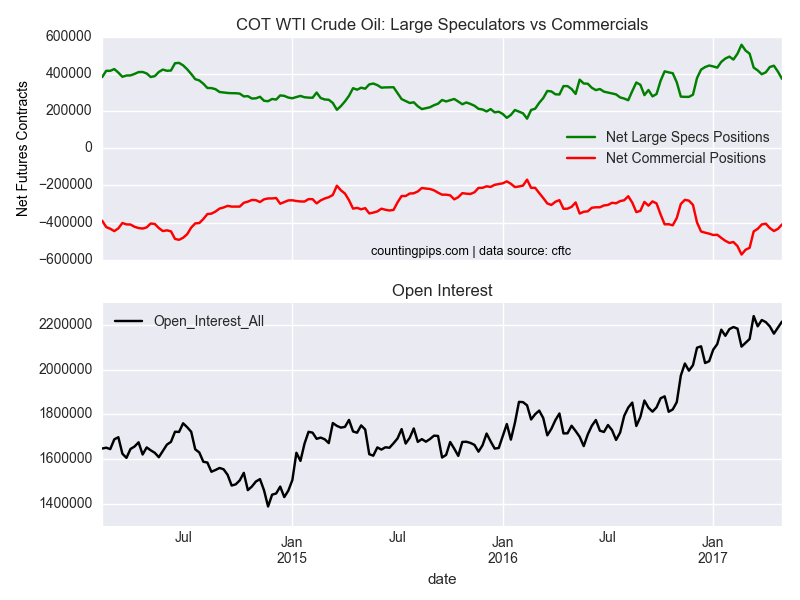

Large speculators sharply decreased their bullish net positions in the WTI crude oil futures markets last week for a second straight week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial contracts of WTI crude futures, traded by large speculators and hedge funds, totaled a net position of 373,144 contracts in the data reported through May 2nd. This was a weekly drop of -38,678 contracts from the previous week which had a total of 411,822 net contracts.

Last week’s decrease was the second straight week of a more than a -30,000 contract decline and brought the overall bullish net position to the lowest level since November 29th when net positions totaled 287,881 contracts.

WTI Crude Oil Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -409,860 contracts last week. This is a weekly gain of 23,765 contracts from the total net of -433,625 contracts reported the previous week.

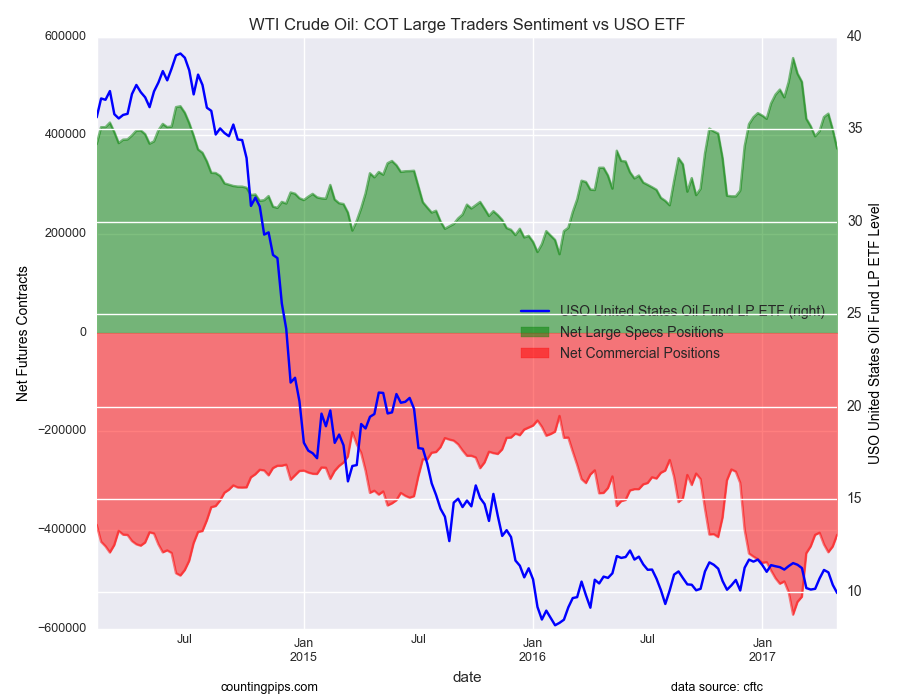

USO (NYSE:USO) Crude Oil ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the USO Crude Oil ETF, which tracks the price of WTI crude oil, closed at approximately $9.92 which was a decline of $-0.44 from the previous close of $10.36, according to ETF market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI