WTI Crude Oil Non-Commercial Speculator Positions:

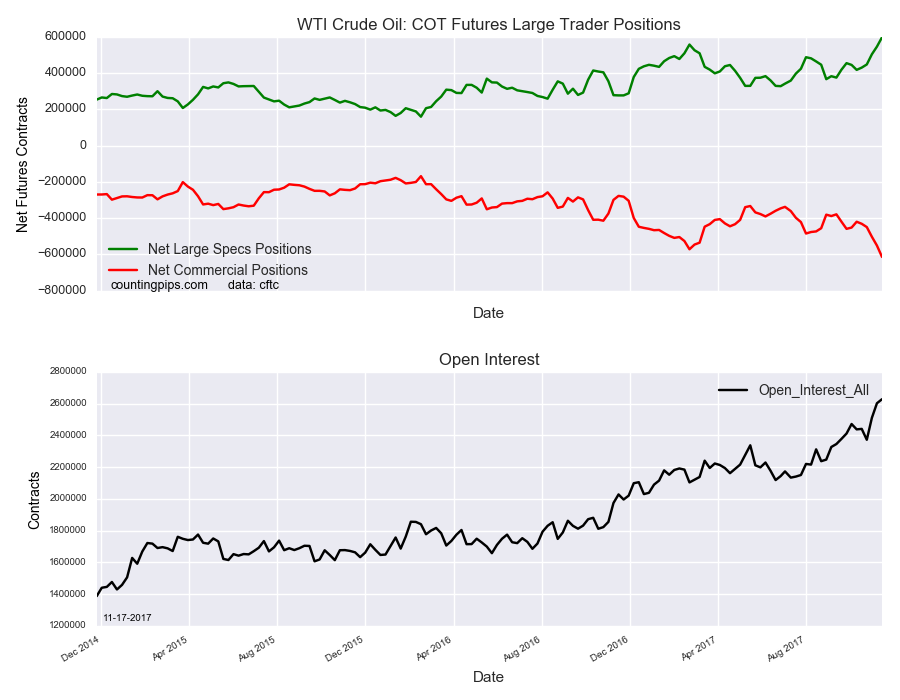

Large energy speculators sharply lifted their net positions in the Crude Oil WTI Futures markets this week to a record high bullish level, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

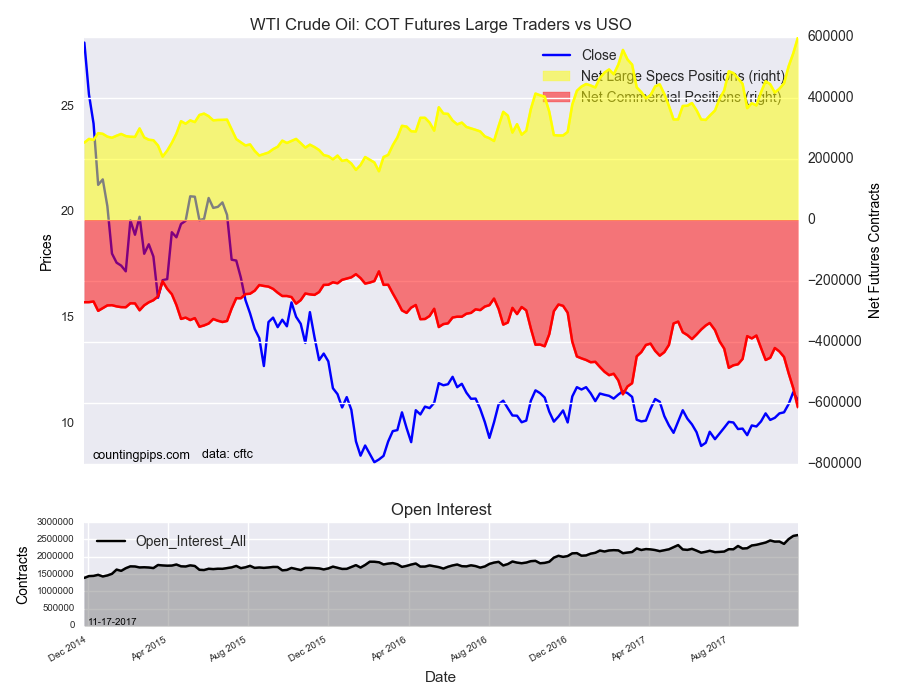

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 596,466 contracts in the data reported through Tuesday November 14th. This was a weekly increase of 51,260 contracts from the previous week which had a total of 545,206 net contracts.

Speculative positions have now risen for five straight weeks (by a total of +179,405 contracts) and on to a new record high that surpasses the previous high of +556,607 contracts that was registered on February 21st of this year.

WTI Crude Oil Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -614,084 contracts on the week. This was a weekly shortfall of -62,677 contracts from the total net of -551,407 contracts reported the previous week.

USO (NYSE:USO):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the USO Crude Oil ETF, which tracks the price of WTI crude oil, closed at approximately $11.13 which was a decrease of $-0.36 from the previous close of $11.49, according to unofficial market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI