WTI Crude Oil Non-Commercial Positions:

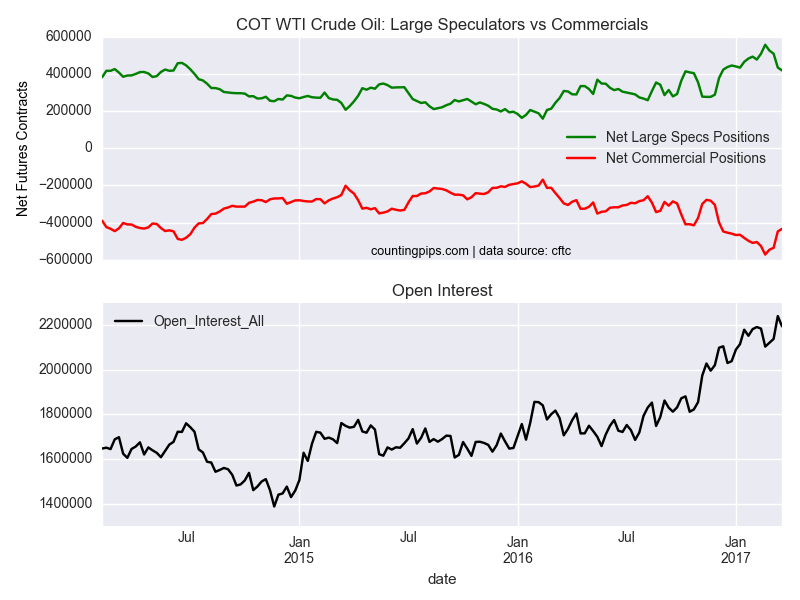

Large speculators and traders continued to cut back on their bullish net positions in the WTI crude oil futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial contracts of WTI crude futures, traded by large speculators and hedge funds, totaled a net position of 418,517 contracts in the data reported through March 21st. This was a weekly decline of -15,283 contracts from the previous week which had a total of 433,800 net contracts.

WTI speculators have now reduced their net positions for a fourth straight week after pushing their bullish bets to a record high level of 556,607 contracts on February 21st.

WTI Crude Oil Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -433,437 contracts last week. This is a weekly change of 13,969 contracts from the total net of -447,406 contracts reported the previous week.

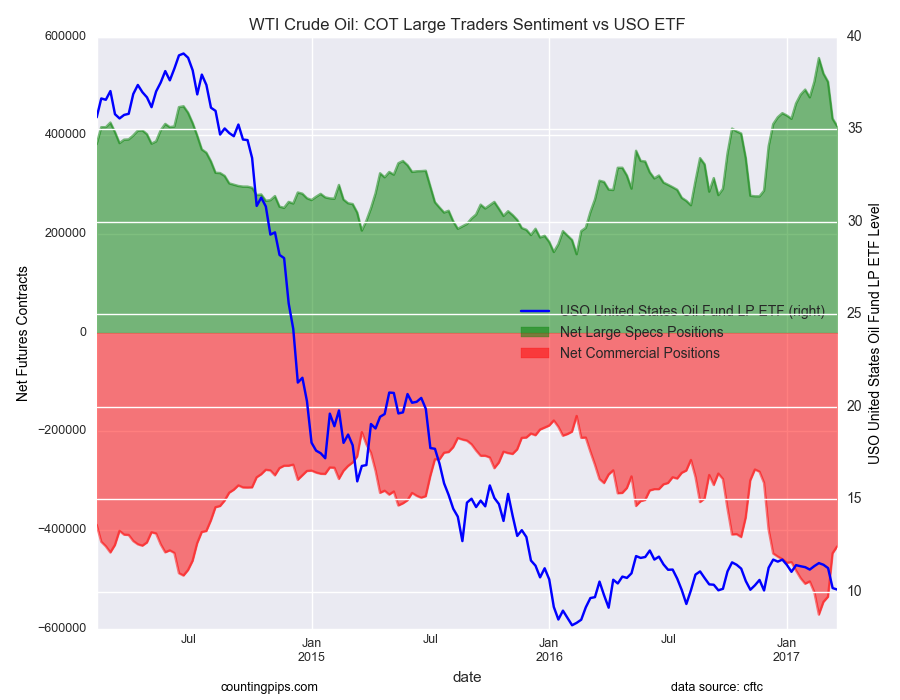

USO Crude Oil ETF(NYSE:USO):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the USO Crude Oil ETF, which tracks the price of WTI crude oil, closed at approximately $10.11 which was a fall of $-0.08 from the previous close of $10.19, according to ETF market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI