WTI Crude Oil Non-Commercial Positions:

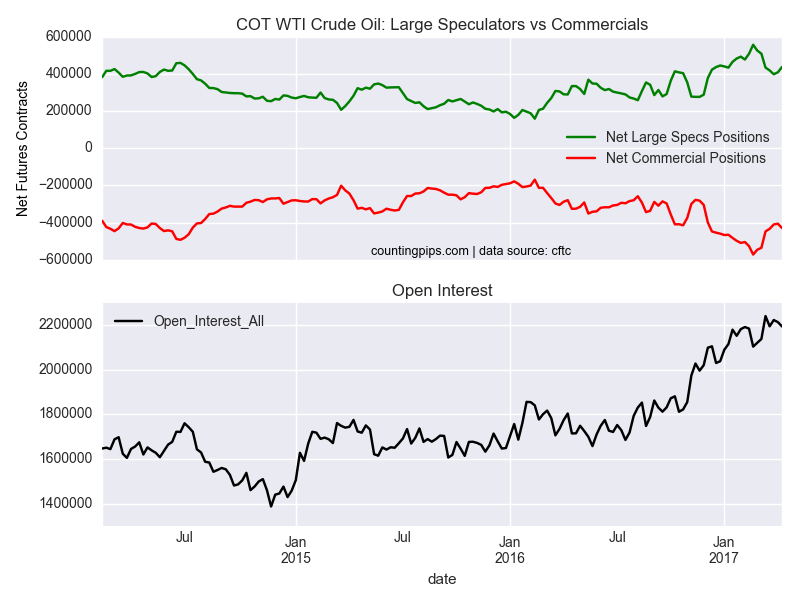

Large oil speculators and traders sharply boosted their net positions in the WTI crude oil futures markets last week for a second week in a row, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial contracts of WTI crude futures, traded by large speculators and hedge funds, totaled a net position of 437,043 contracts in the data reported through April 11th. This was a weekly gain of 28,661 contracts from the previous week which had a total of 408,382 net contracts.

Last week’s sharp gain for WTI oil bets brought the net position to it highest level in five weeks and over the +400,000 contract level for a second straight week. Speculators had recently pushed their bullish oil bets to a record high of +556,607 net contracts on February 21st.

WTI Crude Oil Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -429,398 contracts last week. This is a weekly change of -23,626 contracts from the total net of -405,772 contracts reported the previous week.

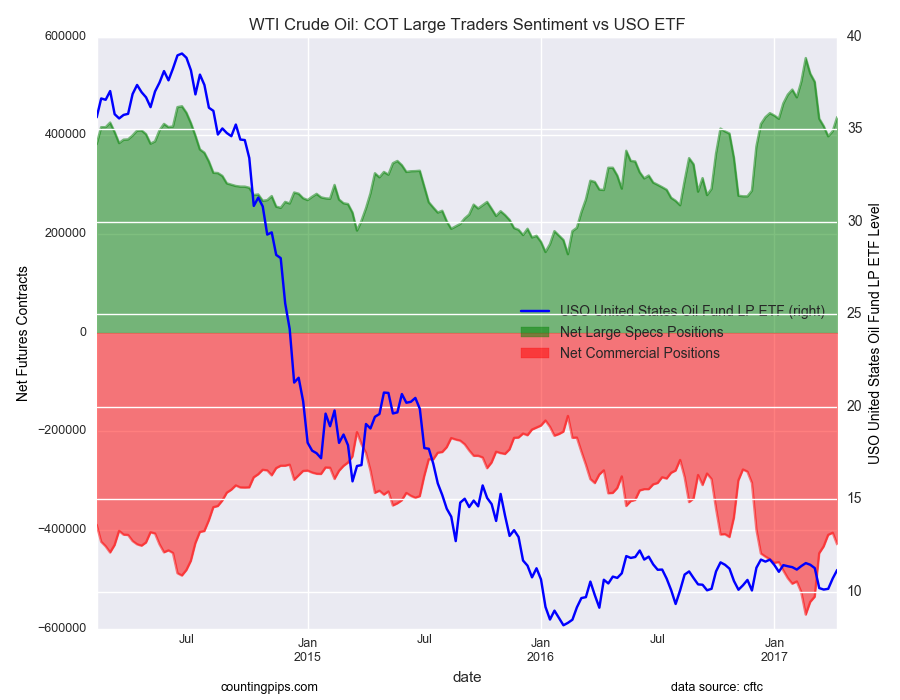

USO Crude Oil ETF (NYSE:USO):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the USO Crude Oil ETF, which tracks the price of WTI crude oil, closed at approximately $11.17 which was an advance of $0.46 from the previous close of $10.71, according to ETF market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI