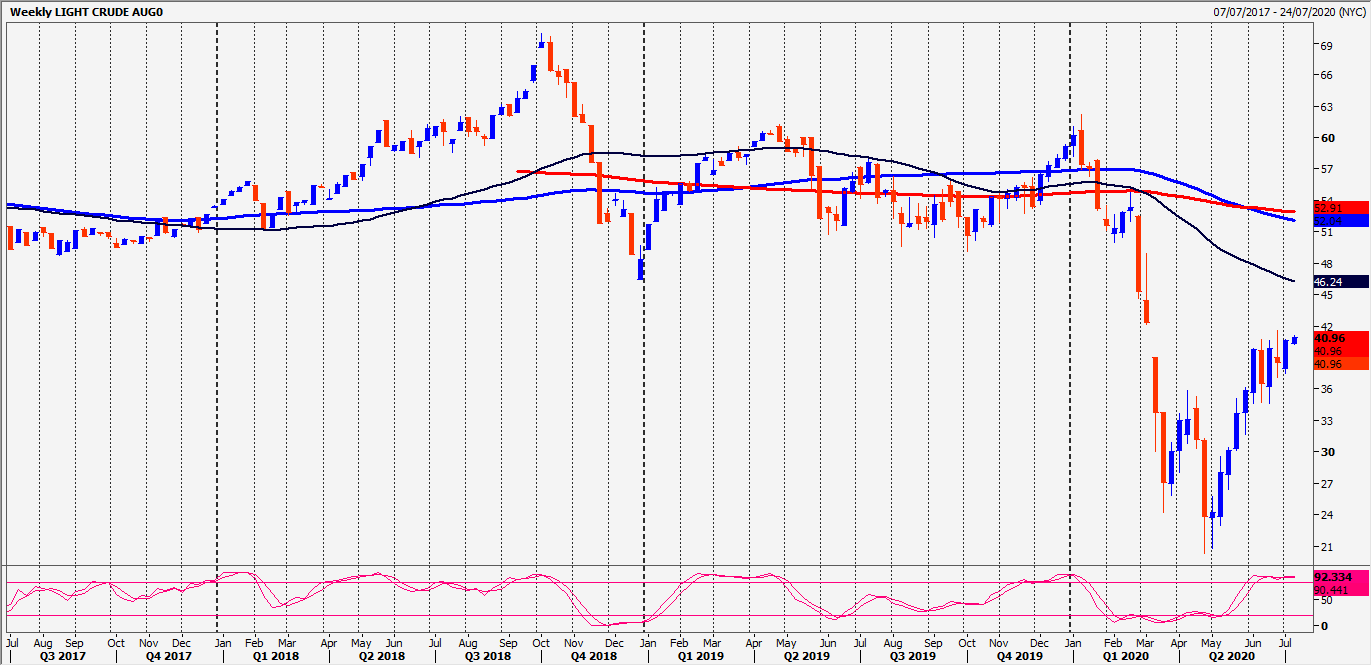

WTI Crude August Futures unfortunately remains in a difficult sideways trend as we expected over a week ago. We wrote: holding above 4040/50 re-targets 4095, perhaps as far as 4110/20. These were pretty much the low and high for the day, so still an easy profitable opportunity.

Today’s Analysis

WTI Crude August holding above 4040/50 re-targets 4095, perhaps as far as minor resistance at 4110/20, which held yesterday. Resistance at 2-week highs of 4150/60 should be more of a challenge. Unlikely but a break higher should fill the gap at 4210/20.

First support at 3990/4010 holding perfectly, but below here is obviously negative for today re-targeting 3950/40, perhaps as far as support at 3910/3890. Exit shorts and try longs with stops below 3850.

Trends

- Weekly outlook is positive

- Daily outlook is positive

- Short Term outlook is neutral

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.