Are DOGE layoffs set to resume?

Oil traders encouraged by Saudi output cut confidence

Oil prices have been given a lift in recent days, with various factors feeding into the gains.

Whether that’s the improved overall risk appetite in the markets, US/Mexico developments or an acknowledgement from the Saudi oil minister that an extension to the output cut is almost guaranteed, the news is bullish for oil prices. It also comes at a time when oil prices needed some good news, having fallen more than 15% over the course of a couple of weeks.

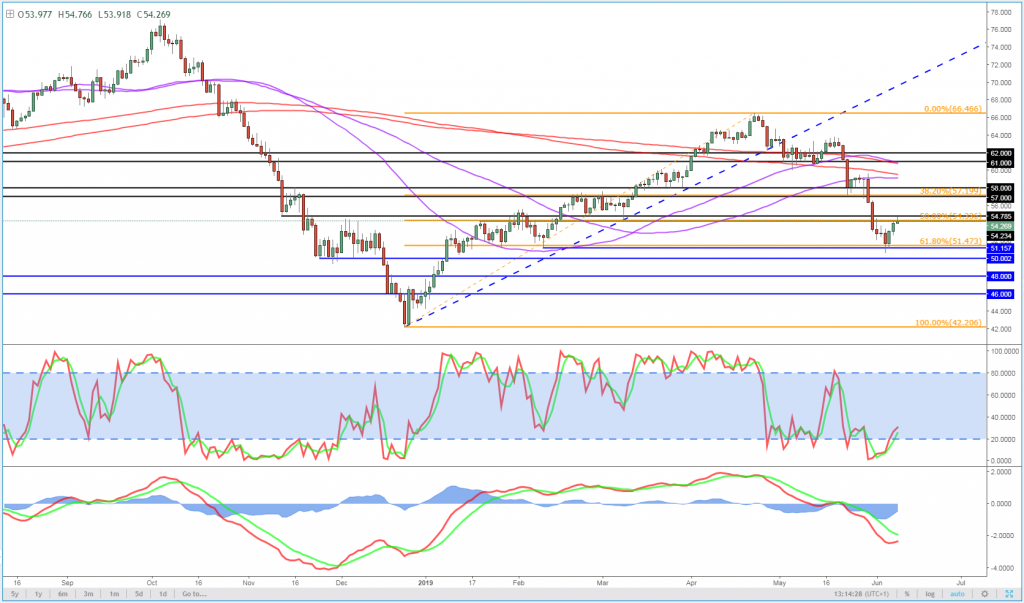

WTI Daily Chart

OANDA fxTrade Advanced Charting Platform

WTI was trading around $50 at the lows which was being talked about as being a fundamentally significant level. From a technical standpoint, this certainly makes a lot of sense. Big numbers are often associated with being significant and $50 certainly ticks that box.

Add to this that it coincides with previous levels of support and resistance – likely because of the previous point – as well as the 61.8% retracement of the move from the 2018 lows to this year's highs and it’s hardly surprising that it’s seeing some support here. The real question is whether it can be sustained.

The price drop likely contributed strongly to Khalid al-Falih’s confidence in a deal, with reports previously indicating that Russia was less enthused about the idea. Of course, price is a major factor in this and the rapid decline may have quickly changed that.

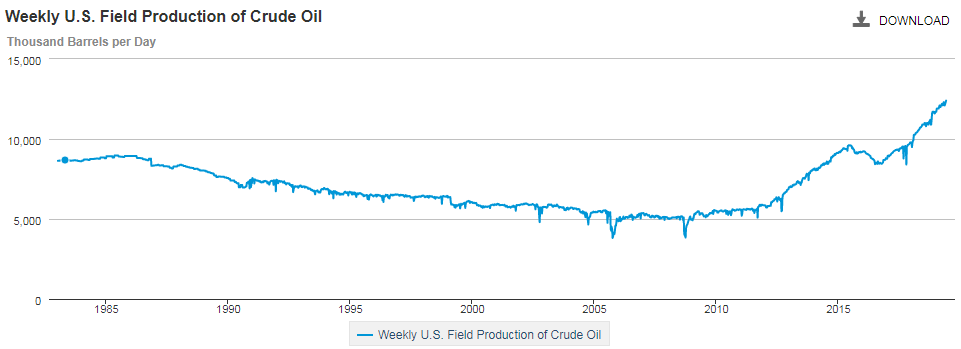

This also comes at a time when the US is setting new records on output, which will be frustrating members of the cartel and its new allies but at the same time reinforces the need for the cuts as price would otherwise be substantially lower.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.