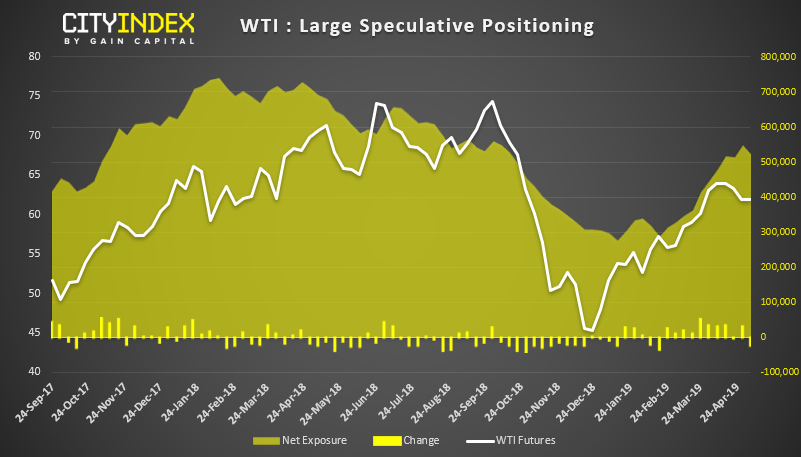

With WTI’s longer-term uptrend in-tact and a cluster of support above $60, we see potential for at least a minor bounce, if not a retest of its highs. That said, the break to highs may not be straight forward given the subtle clues in market positioning.

Traders remain overwhelmingly net-long WTI, although a shift in sentiment was seen in last week’s COT report. Net-long exposure saw its largest weekly reduction since early February, ahead of further declines seen since last Tuesday. The move was driven by an increase of short bets (+16.9k contracts) and a reduction of longs (-6.4k contracts), which could point towards a deeper correction.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.