Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

It’s all about growth at the moment, or indeed, the lack of it. The European Commission has finally got round to doing what everyone in the markets has known for 6 months now; a recession in Europe will not be merely confined to the peripheral nations but will affect core countries as well and the Eurozone therefore will contract over the course of 2012. Obviously the main culprits are the peripheral nations. Greece is expected to enter its 5th year of contraction while Spain and Italy will slip by around 1%.

Growth will be seen in Germany (0.6%) and France (0.4%) through 2012 but these numbers are still contingent on the ability to resolve the sovereign debt crisis soon; something that they have been attempting now for months and months with very little reward. As such, the figures are slightly more bullish than those of the IMF who predicts a fall of 0.5% and ours which is an expected decline of 0.8%.

This morning we have received confirmation that the German economy shrank by 0.2% in Q4 of last year. The main catalyst for this slump was a fall in exports as fears over the debt crisis hammered demand. The data does suggest that we have seen the German economy recover however, since the turn of the year. German IFO, a business sentiment index, rose for the 5th month in a row yesterday while the PMIs, although missing expectations, have remained positive through Q1.

We will get similar confirmation from the UK at 09.30. Q4 GDP in the UK was -0.2% too, according to the preliminary announcement published last month. We think there is a good chance that this figure is revised higher as a result of the improvement in services and industrial figures that were seen towards the close of the period. We are expecting the figure to print at -0.1% and sterling to enjoy a slight bounce as a result.

And a slight bounce is what it needs having gone 4 consecutive sessions without gaining versus the euro. It has been able to move higher against the USD, however, as the greenback is sold by oil producers and those looking to carry trade these markets higher.

The pound did receive some support yesterday from the latest round of manufacturing data from the CBI that showed total orders rising to the highest since August and the export component at the strongest level in the survey’s 35 year history. While this series is typically volatile it suggests that the 0.8% contraction in manufacturing output through Q4 was merely a blip.

Apart from those UK GDP numbers the calendar is fairly quiet today. US consumer confidence is expected to move higher following another good month of jobs numbers stateside.

Have a great weekend.

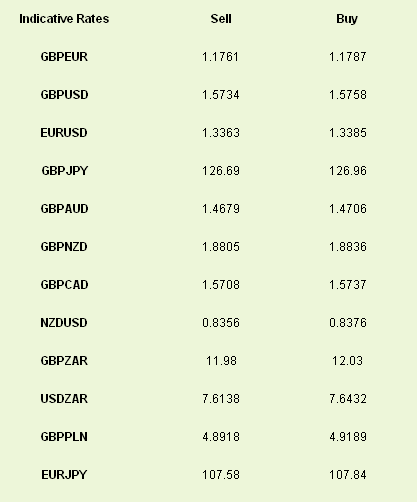

Latest exchange rates at time of writing

Growth will be seen in Germany (0.6%) and France (0.4%) through 2012 but these numbers are still contingent on the ability to resolve the sovereign debt crisis soon; something that they have been attempting now for months and months with very little reward. As such, the figures are slightly more bullish than those of the IMF who predicts a fall of 0.5% and ours which is an expected decline of 0.8%.

This morning we have received confirmation that the German economy shrank by 0.2% in Q4 of last year. The main catalyst for this slump was a fall in exports as fears over the debt crisis hammered demand. The data does suggest that we have seen the German economy recover however, since the turn of the year. German IFO, a business sentiment index, rose for the 5th month in a row yesterday while the PMIs, although missing expectations, have remained positive through Q1.

We will get similar confirmation from the UK at 09.30. Q4 GDP in the UK was -0.2% too, according to the preliminary announcement published last month. We think there is a good chance that this figure is revised higher as a result of the improvement in services and industrial figures that were seen towards the close of the period. We are expecting the figure to print at -0.1% and sterling to enjoy a slight bounce as a result.

And a slight bounce is what it needs having gone 4 consecutive sessions without gaining versus the euro. It has been able to move higher against the USD, however, as the greenback is sold by oil producers and those looking to carry trade these markets higher.

The pound did receive some support yesterday from the latest round of manufacturing data from the CBI that showed total orders rising to the highest since August and the export component at the strongest level in the survey’s 35 year history. While this series is typically volatile it suggests that the 0.8% contraction in manufacturing output through Q4 was merely a blip.

Apart from those UK GDP numbers the calendar is fairly quiet today. US consumer confidence is expected to move higher following another good month of jobs numbers stateside.

Have a great weekend.

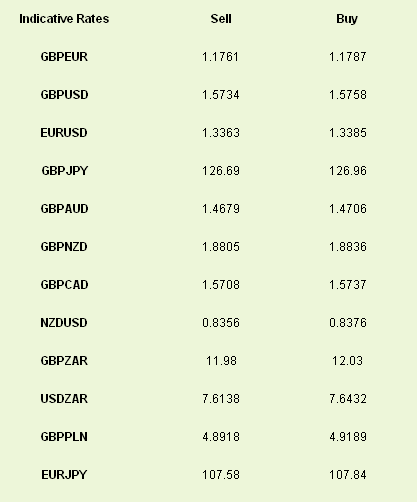

Latest exchange rates at time of writing