Stock market today: S&P 500 in weekly loss as trade war fears intensifyy

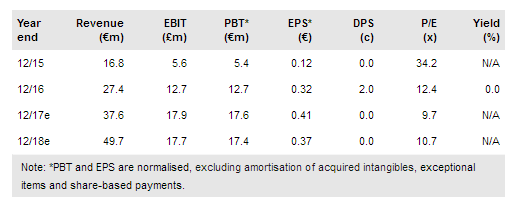

Mondo TV (MC:MONIB) has radically improved its financial profile over the last three years and targets a tripling of EBITDA over the next five. Funding is in place and the new strategy is underpinned by a number of shows with high-margin licensing and merchandising potential. Announcements of additional licensing deals or significant new partners should help build confidence in the deliverability of its ambitious targets and close the 20% FY18 EV/EBIT discount to peers.

Internationalisation strategy is paying off

Since changing its strategy in 2014 to increase its international exposure, Mondo has developed its network of Asian partners and now generates over 80% of revenues from the region. This has enabled it to almost quadruple investment in content and, as Mondo focuses on brands that have a high degree of licensing and merchandising potential, supported significant growth in these high-margin revenues; in FY16, sales increased by 55% and EBITDA more than doubled.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.