FY17 was a pivotal year for Windar Photonics Plc (LON:WPHO). An order for 300 units towards the year-end helped drive a doubling in revenues and suggests that the wind turbine industry is beginning to adopt its wind measurement technology. We leave our estimates and indicative valuation of 125p/share broadly unchanged, noting the potential for a substantial rise in indicative valuation once management is able to announce that the technology has been designed-in by turbine manufacturers, which is a key catalyst for volume deployment.

Strong growth in FY17

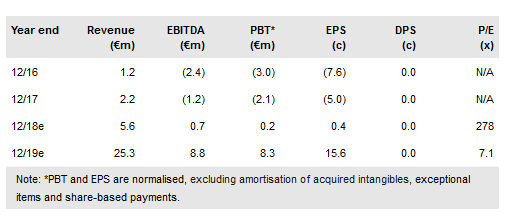

As flagged in the pre-close trading update, FY17 revenues rose by 85% y-o-y to €2.2m. This strong revenue growth was primarily driven by demand from independent power producers (IPPs). Growth was particularly strong in China. The cost base realignment resulted in a €0.8m reduction in operating costs to €2.2m and contributed to a €1.2m cut in EBITDA losses to €1.2m. In July 2017, Windar completed a subscription raising £1.25m (gross) at 82p/share, resulting in Windar having cash holdings of €1.1m (excluding restricted cash) at the end of December 2017. Noting arrangements with the Danish Export Credit Agency and a factoring agency to reduce working capital requirements, we calculate that this is sufficient to take Windar through to a sustainable cash-generative situation.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.