The US economy is growing again. The growth to date is largely due to the snap-back effect that followed a sudden, sharp decline in output, but recent data clearly show that the coronavirus recession has bottomed and a recovery is unfolding. The mystery is whether the recovery will persist. The primary reason for the mystery, of course, is the uncertainty linked to COVID-19.

Let’s start with the good news. Several key indicators have bounced back after devastating losses. Non-farm payrolls posted two strong monthly increases in May and June. Although the back-to-back gains were the highest on record (2.7 million and 4.8 million) for the data set, the increases only recover about a third of the losses for March and April. Nonetheless, the labor market appears to be making progress after the steepest job losses since the Great Depression.

Similarly upbeat numbers have been reported in other corners, including retail sales and manufacturing. Yesterday’s sentiment data for the services sector joined the list of rebounding indicators: The ISM Non-Manufacturing Index rose sharply in June, reflecting a solid pace of growth and suggesting that the recession for this key sector ended last month.

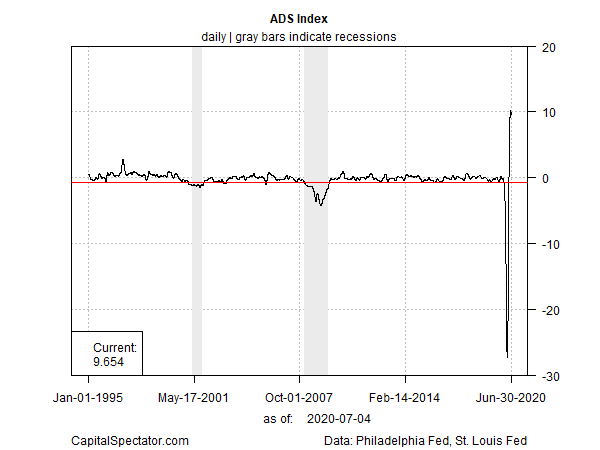

Measuring the broad trend of economic activity through the Philly Fed’s multi-indicator ADS Index also shows a strong pace of recovery. Indeed, the bounce in the ADS is nothing less than extraordinary (based on the current revision through July 2.

On initial review, it appears that the ADS-defined recovery is unprecedented and in some respects that’s true. But the unusually dramatic rebound for this index is largely a function of the spectacular decline that preceded the current recovery. Keep in mind, too, that ADS revisions can swing widely and so the weeks ahead may reveal a different story.

The initial bounce in the ADS and other indicators, however, is also misleading since the latest rate of growth is destined to normalize. The path of that normalization will, for the foreseeable future, be primarily if not exclusively determined by progress (or the lack thereof) on containing, managing and treating the coronavirus.

On that front, the critical factor is developing and distributing a vaccine. Recent news in this corner is encouraging, but as White House health advisor Dr. Anthony Fauci advised yesterday: a vaccine’s efficacy may be short-lived. “It’s not going to be like a measles vaccine,” he said.

“So there’s going to be follow up in those cases to see if we need a boost. We may need a boost to continue the protection. But right now we do not know how long it lasts.”

There’s also uncertainty about the arrival of a vaccine, or even if an effective one will be developed.

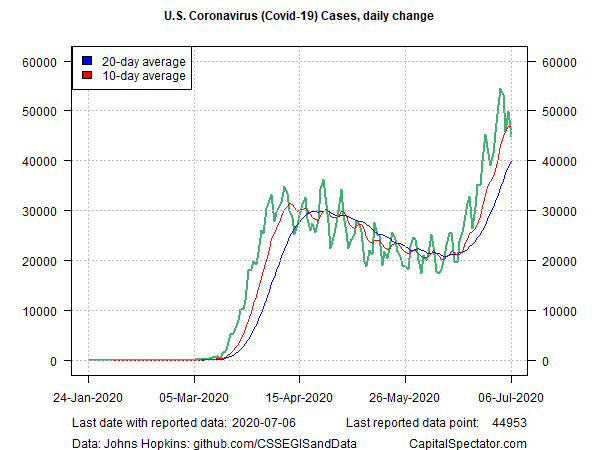

Meantime, the progress in managing the spread of Covid-19 in the US has been fading in recent weeks as the number of reported cases surge. A month ago, the daily change in number of cases fell below 20,000 at one point, but has since rebounded sharply, hovering around the 50,000-per-day mark in recent days, based on data from Johns Hopkins University.

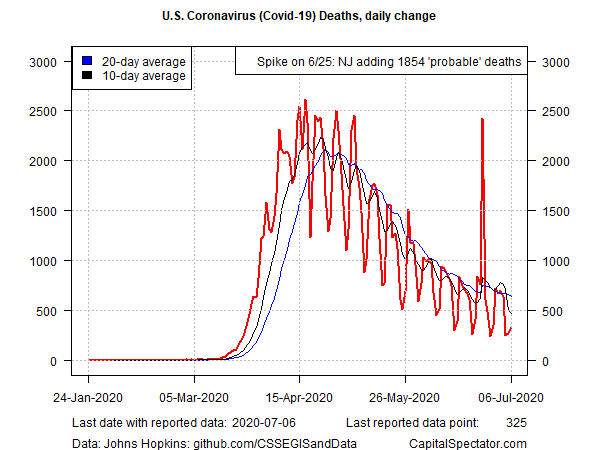

Fortunately, there’s been no commensurate rise in the daily change in COVID-19 fatalities. But it’s unclear if the number of deaths will soon rise vs. another explanation that’s more encouraging.

As for the economic outlook, the July and August profiles will be crucial tests for deciding if the rebound marks an end to the coronavirus recession. The alternative possibility: the latest gains are temporary in a downturn that will roll on in some degree for the foreseeable future.

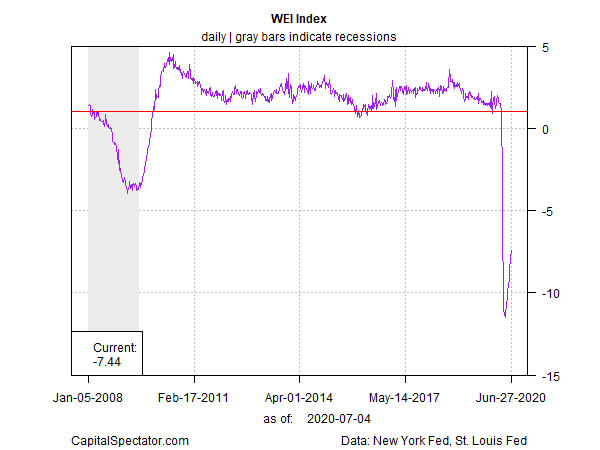

In fact, another real-time economic index offers a sharp contrast to the upbeat profile via the ADS Index. The New York Fed’s Weekly Economic Index has bounced recently, but according to this gauge the recovery looks dramatically weaker relative to the results for the ADS numbers.

Considering both business cycle indexes together suggests that economic risk remains elevated. Perhaps not surprisingly, that’s the message from Raphael Bostic, president of the Atlanta Fed. He offered a cautionary outlook yesterday, suggesting that it’s premature to issue the all-clear signal for the economy.

“There are a couple of things that we are seeing and some of them are troubling and might suggest that the trajectory of this recovery is going to be a bit bumpier than it might otherwise,” he said.

“We’re watching this very closely, trying to understand exactly what’s happening.”