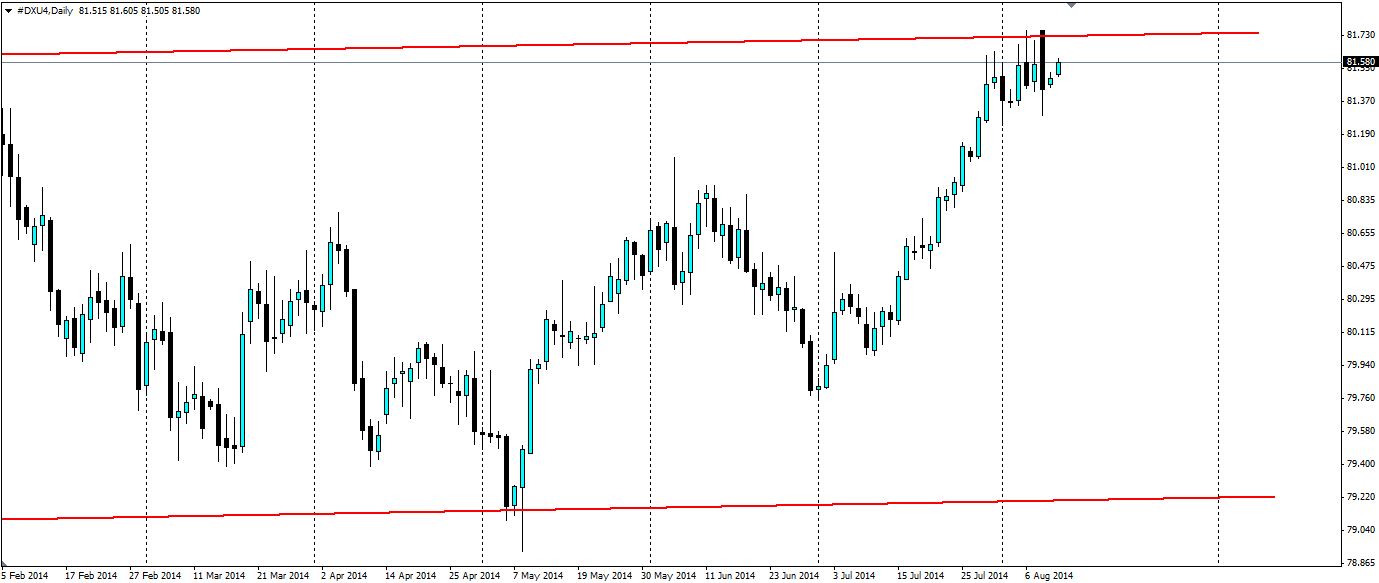

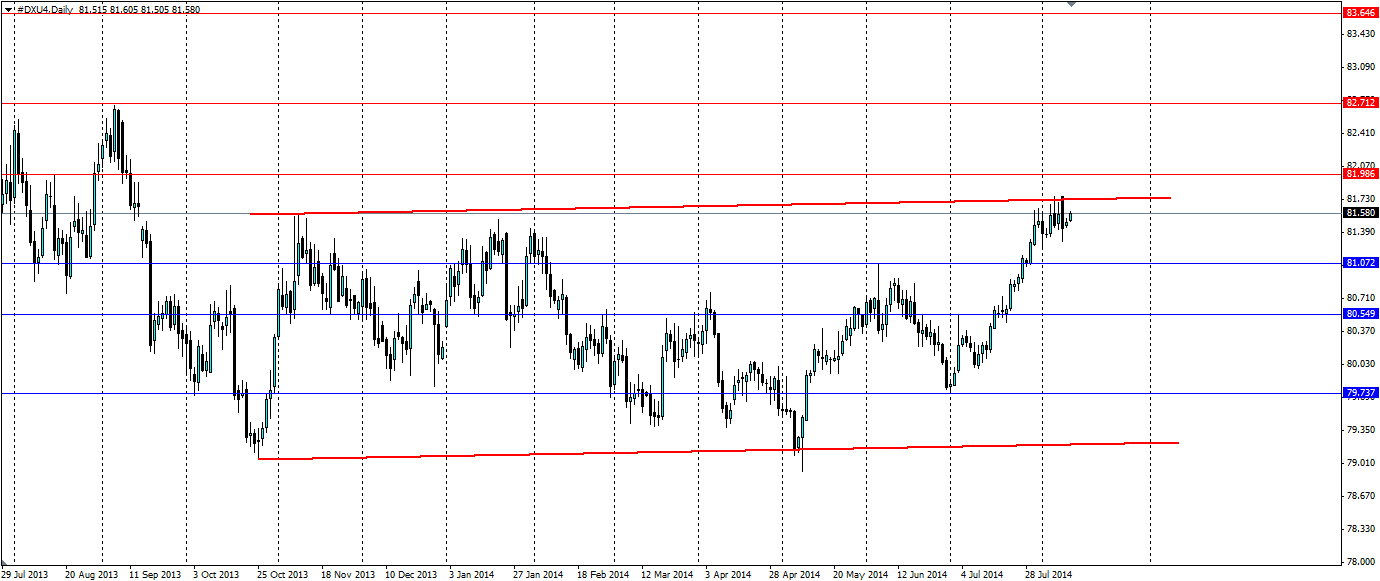

The US Dollar Index has had a strong run, but it met its match at the 81.75 level as global tensions mounted making it tough to break out. Could the reduction of global risks lead a breakout of the channel?

There has been a reduction in global geopolitical risk as of late with Russia announcing an end to the military exercises they were doing in regions that border Ukraine. This is surprising to many as it looked like they were preparing for an invasion. Nevertheless, this will ease tensions in the area and the US dollar will benefit as capital returns after hiding out in safe haven assets.

The US also announced it will aid the Iraqi military by performing airstrikes on the ISIS militant group trying to establish an Islamic state in the north of Iraq. This appears to be having an effect, halting their advance southward. A new Prime-Minister has been nominated in Iraq and US President Obama called the nomination a “promising step forward”. He also urged the formation of a new government that represents all of Iraq’s communities.

The third piece in the set of reduced global tensions is the conflict in Gaza. Israel and Hamas appear to be abiding by a ceasefire that came into force three days ago. Israel is sending negotiators to Cairo for talks on a longer truce that could see the blockade lifted on Gaza

All of this could lead to a resumption of the upward movement in the US dollar, which has been on for some time. Optimism can be powerful and certainly, from a risk point of view, it is returning to the market. This week will be a telling one for the US dollar and it is likely to test the resistance at 81.75. Traders looking to take advantage of any upward momentum should wait for the confirmation of a breakout, with a stop loss set back inside the channel. Look for a breakout to target previous levels of support at 81.99, 82.71 and 83.65.

In an environment of risk-on, the US dollar could break out of the channel it has been following for some time. There is certainly plenty of bullish sentiment that could lead to a resumption of the upward momentum.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI