Ether price near $4,861 record high amid flurry of corporate buying

European equity markets are trading a little lower on Thursday while U.S. futures are pointing to a slightly positive open, as traders look towards the ECB press conference for insight into whether the floodgates could open again in the coming months.

It’s too early for the central bank to consider further stimulus at this meeting having only unleashed the bazooka in March but investors will be looking for any suggestion that additional easing could be on the cards in the upcoming meetings. The euro quickly reversed course during Draghi’s last press conference after he suggested that rates had once again reached their lower bound, with focus now being on improving credit channels rather than weakening the currency.

While that is meant to be the policy of these major central banks, the idea that further easing could be focused at improving lending and stimulating the economy doesn’t do much for the euro which has remained at elevated levels since the meeting. It will be interesting to see whether Draghi reverts back to old tricks in today’s meeting and tries to talk down the euro in the absence of being able to actually use policy tools in order to drive it lower.

The eurozone recovery has been mild to say the least but what we have seen has benefited greatly from the currency weakness and the appreciation over the last month or so will have done nothing to help this. What’s more, inflation is still running well below target at 0%, even the core reading is 1%, well below the central bank’s target of below but close to 2%. Given the currency appreciation over the last month, this could come under further intense pressure in the months ahead which may force the ECB to act again, unless Draghi can have more success today.

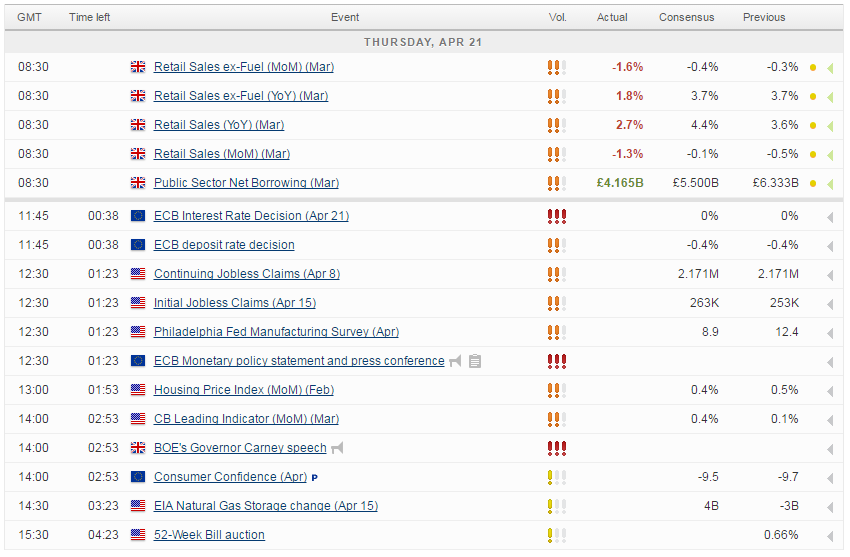

We’ll also get a lot of economic data from the U.S. today with jobless claims, Philly Fed manufacturing index and CB leading indicator figures being released. It’s also worth noting that a large number of companies will release earnings today which could dictate investor sentiment throughout the U.S. session.

Crude Oil is continuing to trade higher on Thursday, having made impressive gains on Wednesday following the latest EIA crude inventories data which confirmed a rise of 2.1m. The continued rally comes despite the collapse of the output freeze deal in Doha, the resolution of the strike in Kuwait and repeated speculation that Russia could increase output even at these low prices, which in itself has led to speculation that Saudi Arabia may also boost production. With that in mind, we have to assume that this is no longer primarily a supply side driven move and perhaps improving economic conditions in China has forced people to revise up their expectations for oil demand, especially if faster growth in China does rub off on the global economy and therefore demand. There is also the risk of further supply disruptions due to prices being at such low levels for a sustained period of time.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.