With the rise in popularity of cloud computing and storage, more and more software companies have been flooding into the space and those that have executed well and expanded that segment quickly have seen the biggest benefit to their bottom-line. Take Oracle (NYSE:ORCL), for example, which last night reported EPS in-line with the Estimize consensus, but missed revenue expectations by $52M. Just hours before the report, SunTrust upgraded the stock to a ‘buy’ based on high expectations for the cloud segment. Oracle cited Cloud SaaS and PaaS as a strong point, growing 34% in US dollars and 38% in constant currency, promising that by fiscal Q4, that number would grow to 60% in constant currency. After that announcement, while ORCL fell slightly, others in the cloud space such as Adobe Systems (NASDAQ:ADBE) saw a slight increase after being up 1.3% on the day.

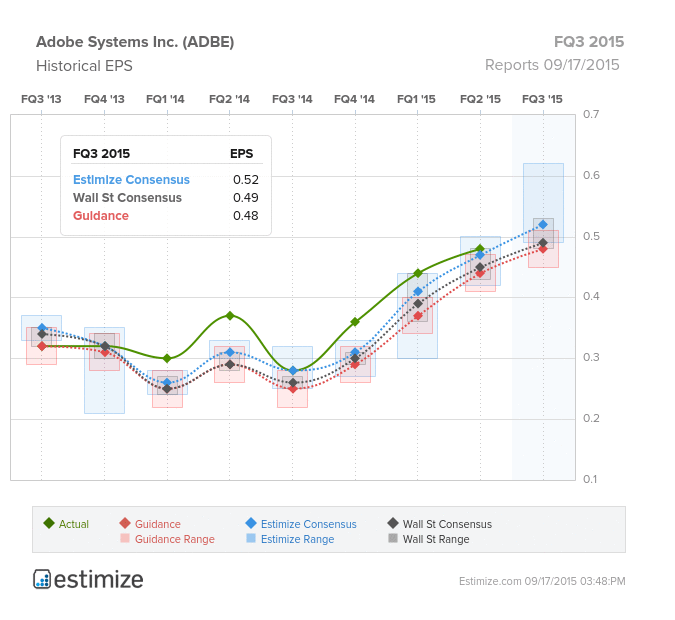

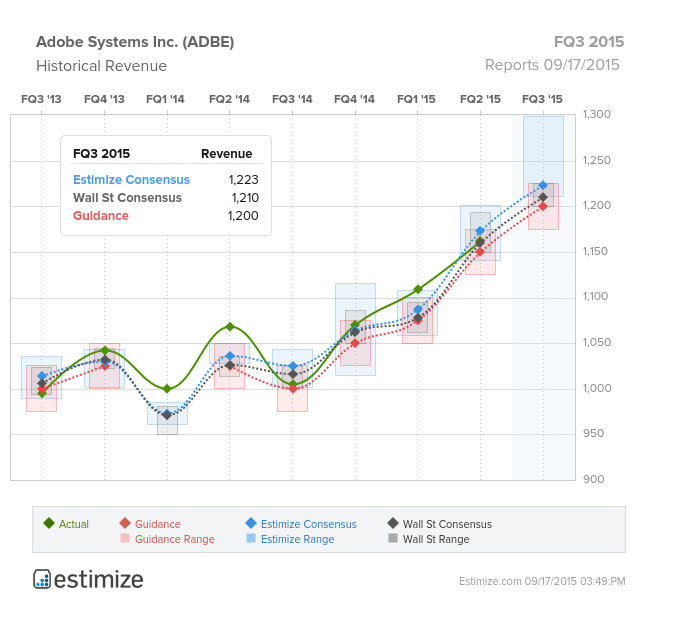

Adobe reports earnings results for its fiscal Q1 2016 quarter after today’s closing bell. The Estimize consensus calls for EPS of $0.52, higher than the Wall Street consensus of $0.49 and corporate guidance of $0.48. The Estimize estimate denotes YoY growth of 86%, with the consensus peaking at $0.56 at the end of July. The Estimize community is also expecting slightly higher revenues of $1.22B as compared to the Street’s estimate for $1.21B and guidance of $1.20B.

A reason for the high expectations has been the rapid progression of the company’s cloud business which helped total quarterly revenue hit an all-time high last quarter. Adobe’s largest segment, Digital Media Solutions, makes up close to 65% of total revenues and is driven by the Creative Cloud, Document Cloud and Marketing Cloud businesses. The company maintains that Creative Cloud subscriptions will hit 5.9M by the end of 2015, up from 4.6M as of the end of Q2. CEO Shantanu Narayen announced the release of their “best Creative Cloud to date” by the end of the year, which includes Adobe Stock, their stock content service.

Last week, Adobe previewed their new video technology for Creative Cloud at the IBC Electronic Media conference in Amsterdam, which includes integration of UltraHD and touch screens. One segment that hasn’t been doing as well is the LiveCycle and Connect business due to a decline in Print and Publishing. Despite all of the promising new updates, Adobe has struggled with the stronger dollar in the past year, although that should subside in Q3 as YoY comparisons get easier. The stock is down 0.04% ahead of the report.

Original Post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.