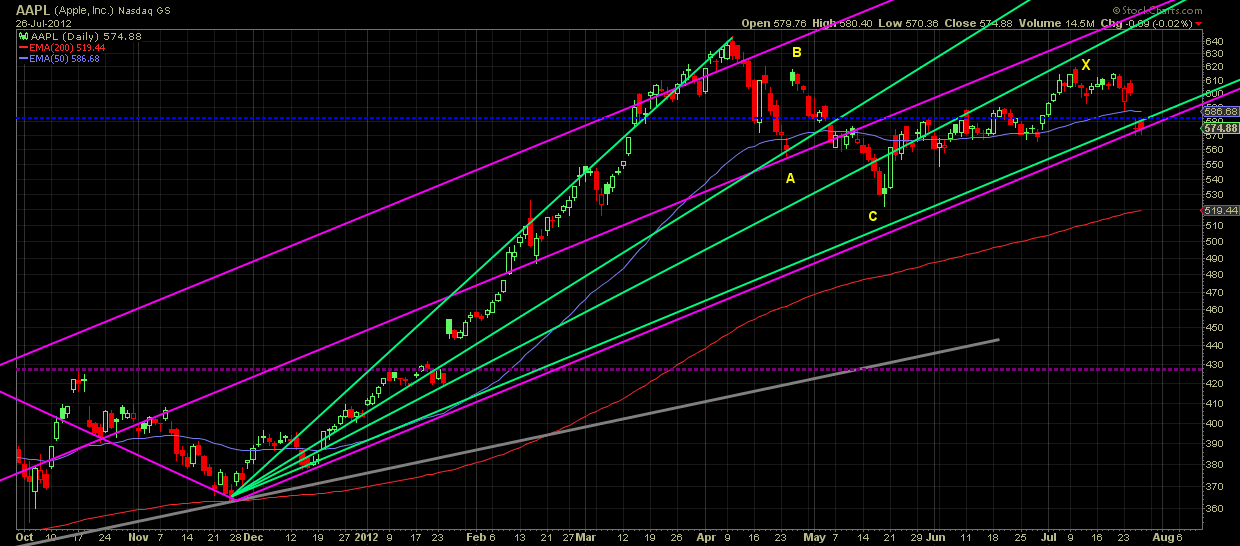

Apple’s (AAPL) sales for the third quarter missed estimates due to weakness in European economy and a pause in iPhone sales ahead of the release of a new version. Following the dissapointing third-quarter financial results, AAPL has dropped to $570 after the announcement. As depicted in the chart, AAPL is right on its longer term support. The rise from $522.18 to $620 does not look impulsive. This move could very well be an X wave. This corrective pattern will end with another downward movement towards $500-450. The first sign would be the break of the support lines (gann fan and pitchfork). This could coincide with our bearish views on S&P. Concluding our view is that $567-570 level should hold if AAPL is to move higher both in short and intermediate term. This price level can also be a reverse point for ones' position as it can accelerate pressures towards $550-520.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI