Last year, one of the persistent themes in the forex market was the “King Dollar” trade. The US dollar rose consistently as the US economy outperformed its peers in Europe and Asia, driving the widely-followed dollar index (below) to a new 9-year high near 91.00. As we move into 2015, the key question on many traders’ minds is whether King Dollar will extend his reign into another year, making it into a multi-year “dynasty.”

To answer that question, it’s important to analyze the factors that drove the greenback higher throughout last year. The most obvious, and in our view, most powerful catalyst was the strong performance of the US economy. This strong economic performance pushed the Federal Reserve to become the most hawkish of the world’s G10 central banks. Traders were reminded of this dynamic earlier today, when Cleveland Fed President Loretta Mester delivered a series of upbeat comments on Fox Business; in the interview, Mester stated that she “could imagine interest rates going up in the first half of the year," far earlier than many traders currently expect. That said, Mester is officially out as a voting member of the FOMC, so her opinion on monetary policy carries less weight than it would have a few months ago.

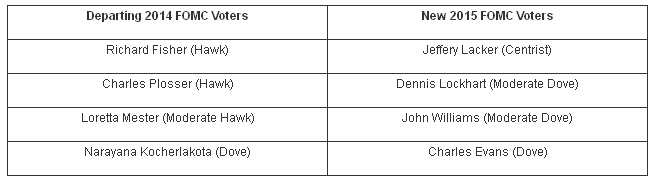

In fact, the Federal Reserve as a whole may see a bit of a dovish makeover this year. Three stalwart hawks, Presidents Fisher, Plosser and Mester, will rotate out of the the committee, along with the generally dovish Minneapolis Fed President Kocherlakota, to be replaced by Charles Evans (dove), Dennis Lockhart (moderate dove), Jeffery Lacker (centrist), and John Williams (moderate dove). The table below summarizes these changes:

The new, more dovish composition of the FOMC poses a potential under-the-radar risk to the dollar’s rally in 2015. Of course, all Fed members are at pains to declare that their views are “data dependent,” so as long as the US economy continues to show strong economic growth, the FOMC voters may have no choice but to raise interest rates and drive the dollar higher. However, if inflation in the world’s largest economy fails to pick up, the reputations of the new FOMC voters suggests that they are more likely to err on the side of safety when considering whether and when to raise interest rates.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.