Let's recap the week with a look at swings in the Dow, S&P 500, and momentum.

CNBC reports Dow travels more than 22,000 points in one of the wildest weeks since the financial crisis.

I think that is quite a bit of nonsense, as it measures every intraday swing no matter how small.

Let's look at thing more accurately.

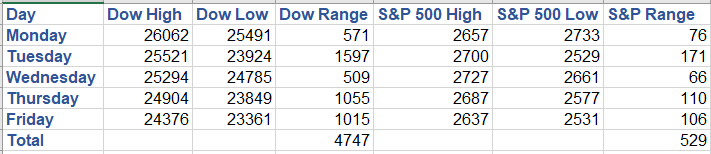

DOW and S&P Trading Ranges

The above chart shows day-by-day changes in futures, rounded to the nearest point.

The weekly fluctuations are quite remarkable. 4747 points for the Dow and 529 points for the S&P 500.

The Dow close last Friday was 25520, the S&P close was 2757 so those are big percentage moves.

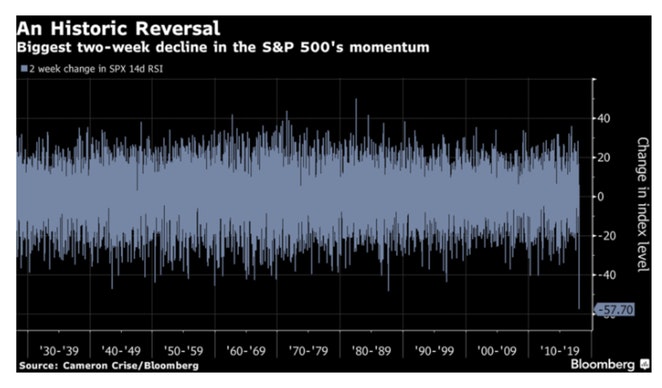

Biggest Momentum Swing in History

Bloomberg reports This Is the Worst Momentum Swing for U.S. Stocks in History.

"The journey from ecstasy to agony is entirely unprecedented, in the United States at least," writes Bloomberg macro strategist Cameron Crise, who earlier noted this inauspicious achievement. "That’s the largest momentum swing in history -- and it’s not particularly close."

The next-closest reversal was a 48-point drop over the same span in 1987.

"This is perhaps one reason to expect that an eventual market recovery might not be totally straightforward," added Crise. "Not only have ’those kids on the trading desk’ never seen a reversal like this, nobody has. How that impacts investor psychology remains to be seen."

Expect more of the same. Stocks are insanely overvalued.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI