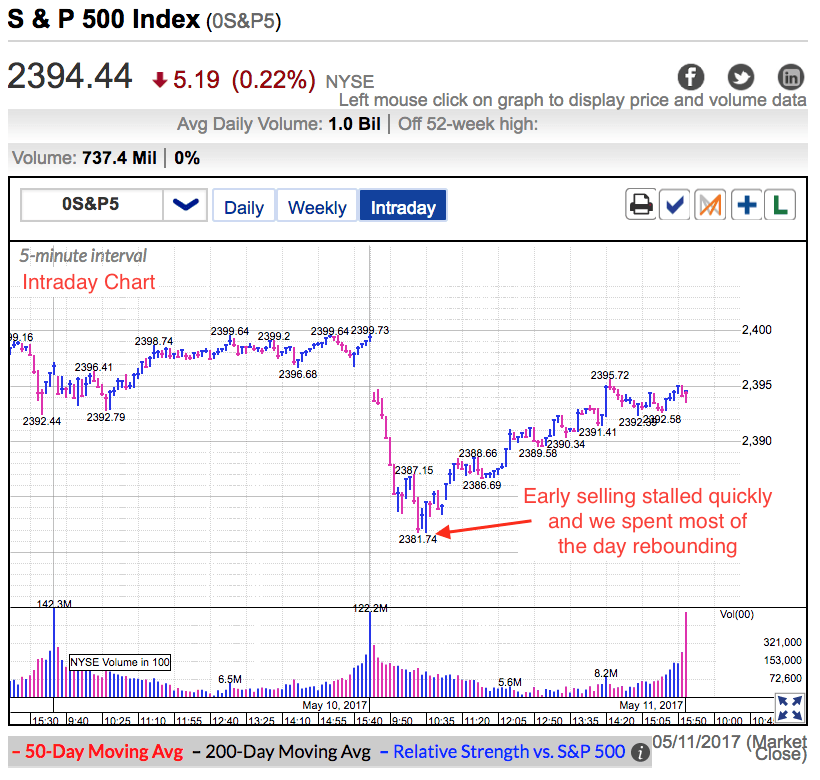

Thursday provided a dramatic ride for the S&P 500. We started the day with the biggest losses in several weeks. Within minutes of the open we undercut 2,390 support and that triggered a wave of reactionary stop-loss selling. But just as quickly as the selloff started, the rush for the exits stalled and we bottomed near 2,380 support.

And just like that, the selloff was over and we spent the rest of the day climbing out of that hole. While we didn’t quite reach breakeven, the intraday reversal was impressive and told us most owners continue to believe in this market and won’t be spooked out so easily.

The biggest headline continues to be Trump’s dismissal of the FBI director. While the media is making a huge deal out of it, the stock market doesn’t care that much. Even at today’s lowest point, we were still within 1% of all-time highs. Hard to call such a small blip panicked selling.

While it felt awful in the moment, all selloffs feel that way. If they didn’t, no one would sell and we wouldn’t dip in the first place. But given how quickly we bounced off the lows, that tells us few owners were spooked by this price-action. Most owners have been rewarded by patiently waiting for higher prices and every bounce makes it easier to hold through the next dip. This confidence is infectious and the VIX is hovering just above all-time lows as traders continue to believe in this market’s strength. While it is easy to claim this market is too complacent, the harder part is figuring out when that complacency will become a problem. At the moment complacency is keeping supply tight because owners are not selling and that is propping up prices. While this might be the calm before the storm, the calm can last for an extended period of time. It is good to be cautious, but shorting just because the market is complacent is costing a lot of smart people a lot of money.

Expect prices to be resilient as long as owners remain confident. Until some headline comes across that makes the crowd start second-guessing their optimistic outlook, expect every dip to keep bouncing. Even though the market is vulnerable with so many people standing on one side, we need a significant event to trigger the panic. Until then the smart money is sticking with the rally.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.