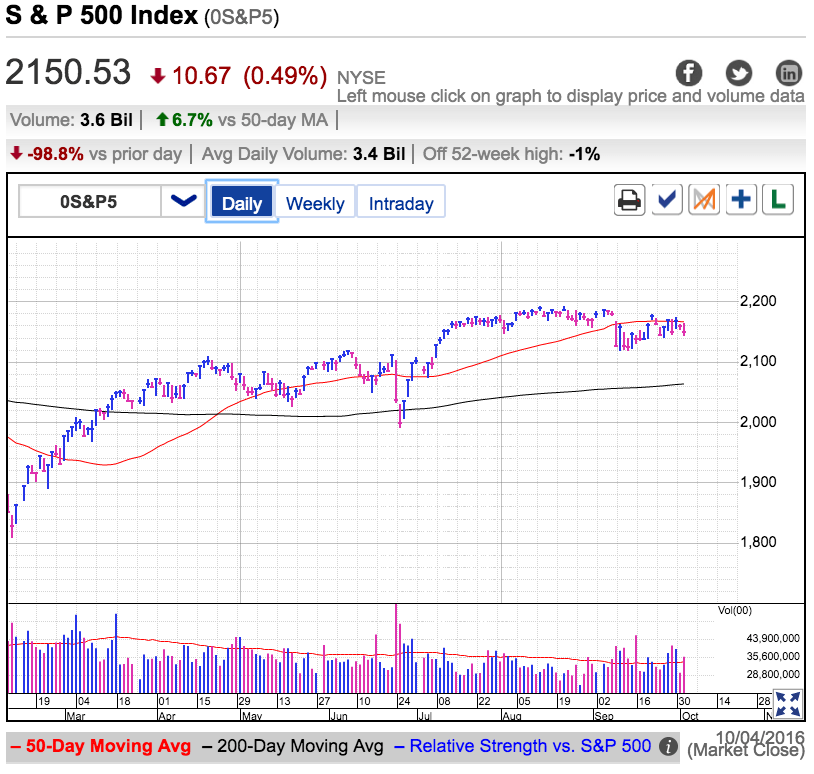

The S&P 500 slipped for a second day as it continues to struggle with 2,160 resistance and the 50dma. Volume was above average, but average is relative since it is calculated using the last 50-days of painfully slow summer trade.

The market crashed under the 50dma in early September as traders woke from their summer slumber just as the Fed started hyping the prospects of a rate hike. While it was a brutal 2.5% selloff, bears haven’t been able to do much since. Volatility has definitely picked up, but we remain stuck in a sideways market.

Directional moves happen when people change their mind. When bulls become less bullish and start selling, or bears become less bearish and start buying. The reason we remain range bound is bulls are stubbornly bullish and bears are stubbornly bearish.

The Brexit bears haven’t been able to do anything with those headlines. At the same time, the no-rate-hike bulls haven’t been able to move the needle either.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI