Last Tuesday, New Jersey became the 3rd state in the country to explicitly ban direct auto selling, effectively outlawing the sale of Tesla (TSLA) electric cars. Tesla forgoes the traditional model of selling cars through franchised dealerships and instead uses showrooms where Tesla employees can directly educate potential buyers about their product and tout the reasons for switching to electric. Why anyone would want to prevent a company like Tesla from reducing the global dependency on fossil fuels is one question, but why they would use anti-competitive practices to do so is a real doozie. And there only seems to be one plausible explanation. It’s the lobbying power of the New Jersey Coalition of Automotive Retailers (NJ Car).

The coalition correctly and unimaginatively pointed out that direct auto sales from a manufacturer to the customer without the intermediary step of a dealership would threaten its members’ livelihood. Okay sure, but since when has fear of competition ever been a valid excuse to prevent a free enterprise from doing business it’s own way? Our economy is based on the belief that companies should provide the highest quality product at the lowest possible price and let the consumers determine who the winners and losers are, not the government. And unless you happen to represent the less than 1% of people who sell automobiles for a living, you probably don’t care much for car salesmen anyway. The simple fact is that we don’t need them and this ban on direct auto selling is detrimental to 99% of New Jersey constituents. But even if we can’t have direct selling, there is hope. BitAuto is making huge strides in China to render auto-dealerships powerless, but more on BitAuto in a second.

One of the primary arguments against direct selling that Jim Appleton, President of NJ Car, made is that auto dealerships offer a public benefit in the event that a recall or warranty issue. Baloney. Do you know what Tesla did when there was a problem with the Model S riding slightly too low to the surface at highway speeds? They didn’t waste millions of dollars of time and money with an old-school physical recall, that’s for sure. Tesla released an over the air software update to each car’s central computer to automatically adjust the suspension and correct the problem. So, what else do auto dealerships do? They thrive on asymmetric information and feed on price discrimination, maximizing the amount that each individual will pay to purchase a car on a discretionary basis. Luckily on the other side of the world, BitAuto (BITA) is changing that.

BitAuto is a online content and marketing company that operates in China which seeks to increase transparency on auto dealerships, and they aren’t happy about it. While they do provide advertising services to automotive dealers, BitAuto also allows buyers to browse and compare dealerships from the comfort of their own home. The emerging middle class in China is driving the auto market crazy there, and BitAuto is in great position to capitalize. Car buyers love having actual pricing information available on the web because it significantly weakens the power of dealerships to overcharge them.

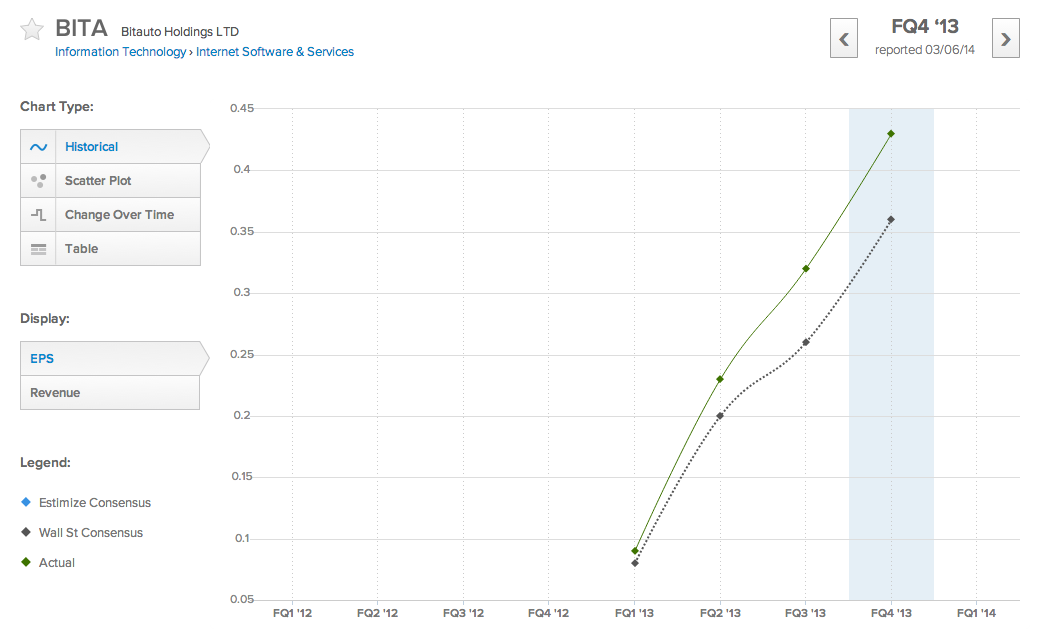

Throughout the past 4 quarters BitAuto has been more profitable than Wall Street has predicted and the company’s revenue is small but growing rapidly. On March 6 BitAuto reported quarterly earnings of 43c EPS and $79.9M revenue compared to just 9c EPS and $39.1M revenue back in May.

Along the rapid expansion in fundamentals, the company’s stock price has run up as well. Since FQ1 earnings were released back in May the BITA share price has tripled from $12.50 to $37.50. In the current market auto dealers still have a good bit of negotiating power and are trying to keep information as asymmetric as possible to protect their high margins. But the divulgence of information coming from sites like BitAuto will arm consumers with the information they need to fairly negotiate the price of a new vehicle without overpaying dealerships, which frankly, add very little value to the modern car buying experience.

It seems likely that franchised auto dealers are going to lose power quickly. With the spread of accurate pricing information, consumers will soon know exactly how much a car is worth and not pay a penny more. If the dealerships want to stay in business, they will need to adapt and find new ways to add value, otherwise, they look like rats on a sinking ship.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI