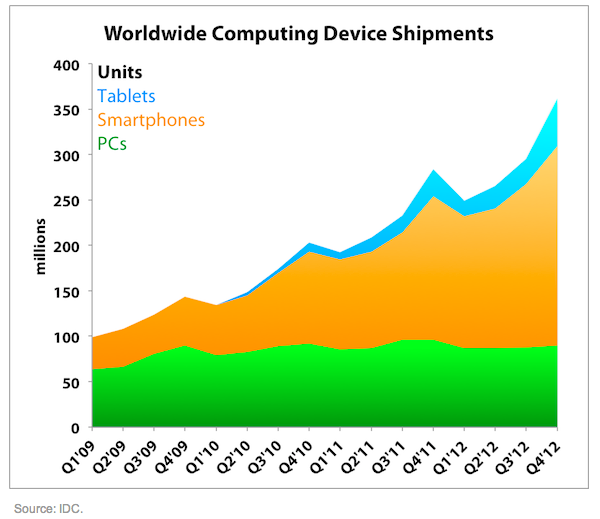

Thursday, Microsoft CEO Satya Nadella made a considerable strategic divergence from his predecessor Steve Ballmer. At his first major public appearance as head of Microsoft (NASDAQ:MSFT), Nadella announced that the Microsoft Office suite would finally be rolled out for Apple’s iPad and other mobile devices as a free download, but subscription based service. In this move Nadella demonstrated humility and a realistic understanding of how the world is changing. Personal computer sales have been flat over the past 5 years while smartphone and tablet sales have exploded. Here’s one simple chart to prove it:

While Balmer focused on Microsoft’s own Windows operating system, this move is a signal that Nadella is not afraid to distance the company from Windows and follow the money into tablets and smartphones by selling professional and enterprise software as a service. Nadella even went as far as to say he was “absolutely committed” to making sure that Microsoft software ran great across different platforms. The announcement makes total sense from Microsoft’s perspective, but why would Apple (NASDAQ:AAPL) allow Microsoft to sell Office 365 through its online store?

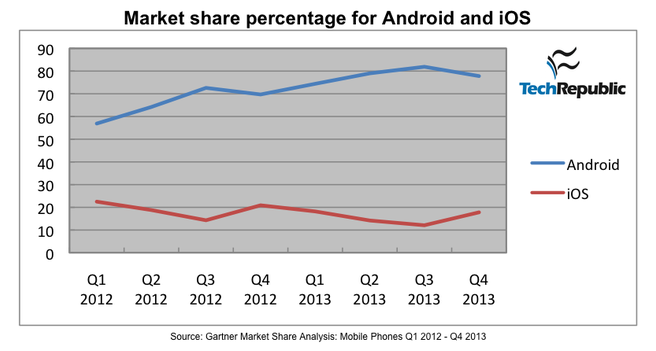

The relationship between Microsoft and Apple has changed dramatically over the past 10 years. In the early 2000s before the smartphone boom, the question was only Mac or PC. It was a matter of whether users wanted the flexibility and wide range of programs available on Windows or the security and simple user interface on a Mac. But those times have come and gone. These days Apple is much more worried about a different competitor, Google Inc (NASDAQ:GOOG). In the age of everything mobile, it’s no longer a game of Apple vs Microsoft. Today operating system warfare is all about Apple’s iOS vs Google’s Android. And when you’re in war, the proverb from over 1000 years ago comes into play, the enemy of my enemy is my friend.

Neither Google or Apple could be happy about the progress Google has made in recent years. Google’s Android mobile operating system is dominating the global smartphone market and Google Drive is threatening Microsoft Office. Google Drive is a free to use Office competitor which also grants users up to 15GB of free cloud storage, a massive perk. Since both Apple and Microsoft have had their business threatened by the growth of Google, teaming up finally makes sense. To be clear Apple is going to take a 30% cut of the Office iPad sales, but this move is bigger than that. Microsoft has finally realized that it’s about time to move away from its dependence on Windows and partner up with its old rival.

Thursday on CNBC, Rick Sherlund from Nomura Securities commented:

“So I may not need to buy that extra laptop, so Microsoft will lose $50 on the sale of the operating system every 5 to 7 years when I buy a new laptop, but they are going to make $100 per year on me subscribing to Office 365. They’re much better off with the subscription revenue on the Office side versus focusing on the Windows platform.”

The upside for this transformation by Microsoft is that at $100 per year instead of $50 every 6 years on average, they only need to retain 1 of every 12 customers to make break even even if they lose 100% of their PC sales, which won’t happen. For prosumers and enterprise customers who rely heavily on Microsoft Excel and Powerpoint, the Office 365 subscription on iOS will make sense. But don’t expect too many casual consumers to fork over $100 per year for Word on their iPad, there’s really no point when iWork and Google Drive are both free.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.