Trump says U.K. would fight for U.S., doubts EU commitment

JP Morgan Chase (JPM) may have officially missed Wall Street’s earnings consensus this morning, but the report was better than the market ACTUALLY expected. And the data suggests JPM stock price will drift upward relative to the broader market, not down over the next three days. Here’s why.

The information below is derived from data submitted to the Estimize platform by a set of Buy Side and Independent analyst contributors.

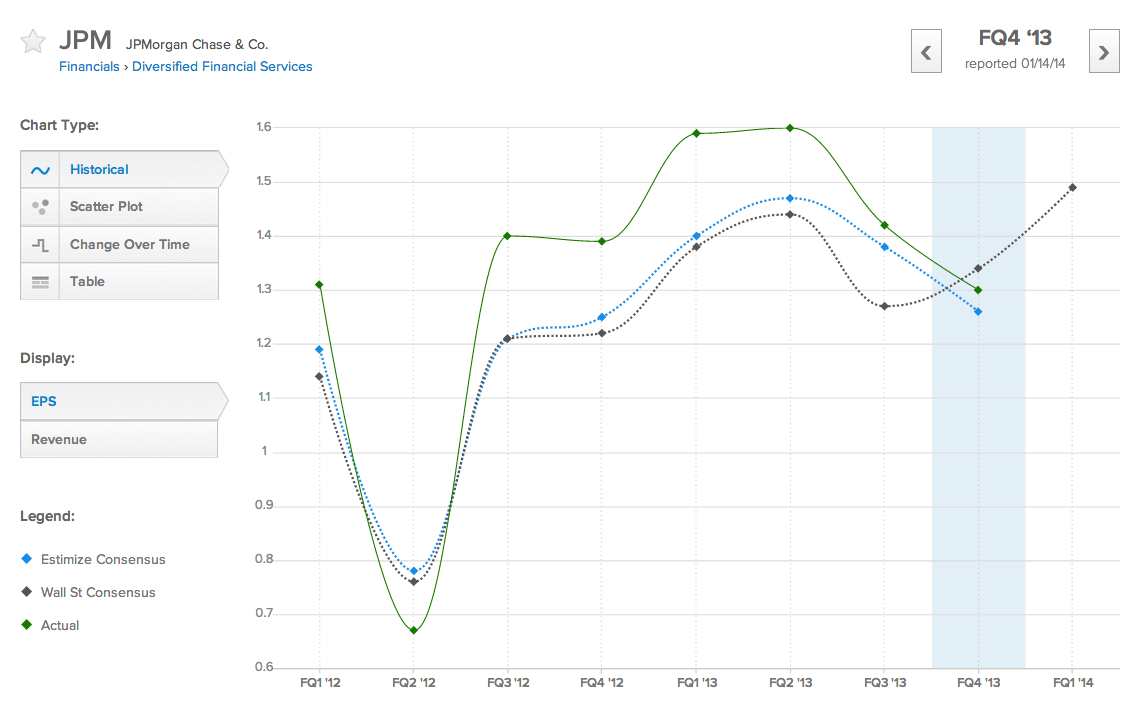

Before the market opened this morning JP Morgan Chase reported $1.30 earnings per share while the Wall Street consensus was $1.34. A set of buy side and independent contributing analysts at Estimize were expecting $1.26, so JPM actually beat the consensus from investors.

Sell-side estimates are plagued by a couple of biases which hinder accuracy. One of which is a misalignment of incentives, the primary motivation of a sell side analyst is NOT to be accurate, it’s job-security. This bias comes from a “don’t stray from the herd” mentality. As long as the sell-side keeps their estimates in-line with one another, then no one can be singled out for poor performance and the result is a less accurate consensus that does not reflect what the market actually expects. That’s why Leigh Drogen launched Estimize.

By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created a data set that is up to 69.5% more accurate than Wall Street, but increased accuracy is just icing on the cake. The real value of the Estimize data set comes from the fact that it better represents the market’s expectations.

In order to to come up with the best possible forecast Estimize crowd sources data from over 3,400 contributors. Confidence ratings for each user are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. This morning the Estimize consensus was only calling for $1.26, which JPM beat by 4c per share despite missing Wall Street’s consensus.

Estimize has released a whitepaper which has been confirmed by an independent academic study from Rice University which shows that if you benchmark against the broader market, a stock’s post earnings drift over the 3 days after reporting earnings is more highly correlated to the Estimize consensus than to the Street’s. That means that over the next three days, it’s reasonable to expect JPM stock price to push higher, not lower.

Get access to estimates for JPM, follow the expectations for earnings season, and register for free to make your own estimates to see how you stack up to Wall Street by heading over to Estimize now.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.