Is the economy finally getting back into gear? Several surprisingly healthy economic indicators reported within the past month including auto sales figures and the most recent jobs numbers indicate that commerce may be picking up. But the big question that will be answered on Friday is whether growth in the labor market kept up its pace through May, or if April hiring was just a 1 month wonder.

A recent report from AutoData suggests that the pace of car sales spiked to an annualized rate of 16.8 million units in May, the fastest rate of growth seen in the auto market in 7 years. The strengthen wasn’t isolated to one or two well performing brands either, even GM managed to double sales growth expectations by reporting a 12.6% gain compared to an estimated 6.4% increase as the company faces one of the biggest auto recall scandals of all time. The automotive data is encouraging, but the nonfarm payrolls change is the indicator traders really keep a close watch on.

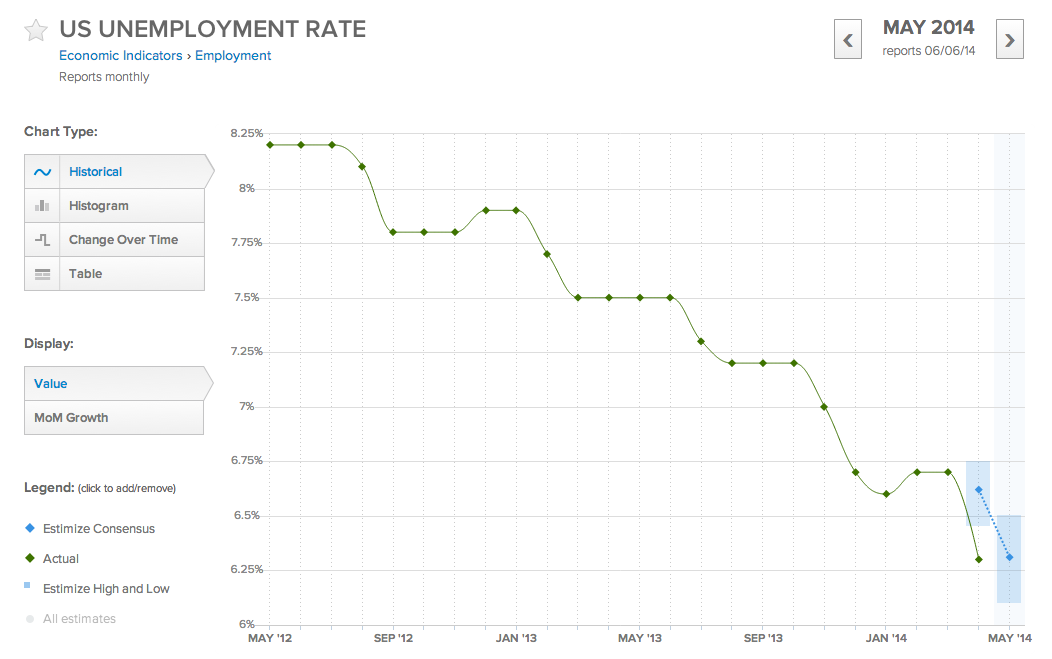

The change in nonfarm payrolls may be the most influential economic indicator (other than perhaps GDP) because it’s reflective of two key factors for the national economy. The jobs number tells us both about the strength of corporations and their willingness to spend cash to expand their businesses, but it also gives insight into the number of newly added employees which may bolster consumer spending with their freshly minted paychecks. The Friday jobs report also contains supplementary information about employee earnings levels and the unemployment rate, which isn’t considered to be as clear of a signal because it is positively influenced when job-seekers drop of out of the labor force in what is known as the discouraged worker effect.

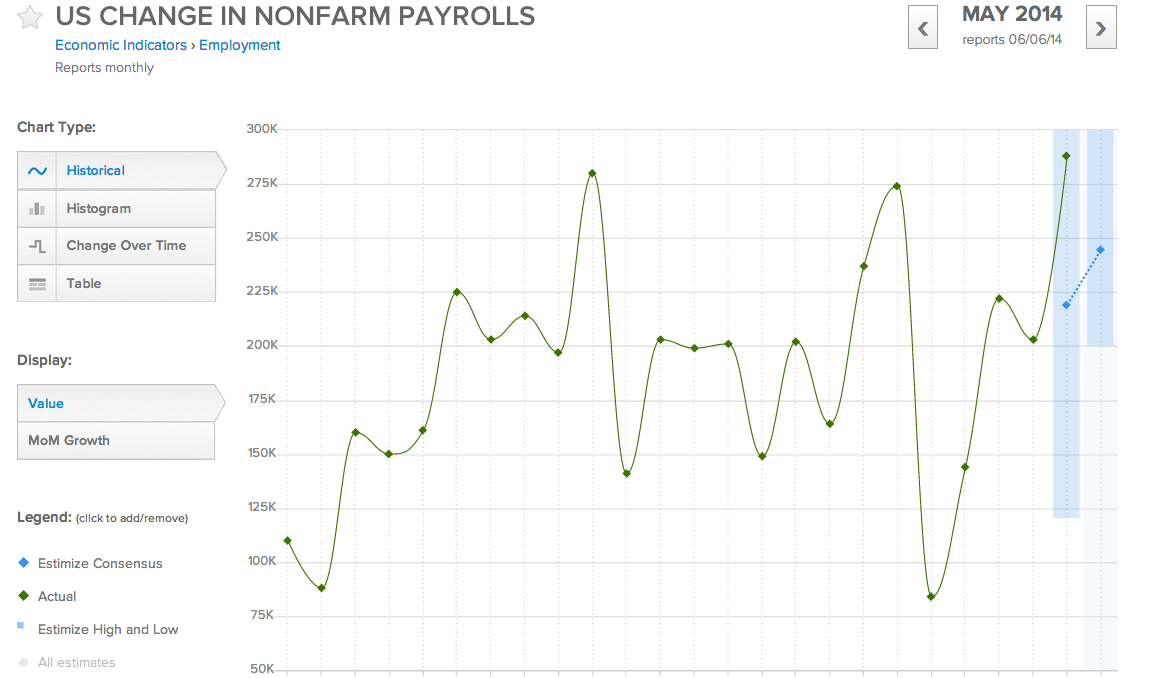

Last month the jobs data was serendipitous, the US change in nonfarm payrolls unexpectedly climbed from 203k jobs added in March to 288k in April, rallying markets around the world. This Friday the May jobs data will become publicly available.

Estimize.com crowdsources forward looking financial estimates from a community of over 4,500 contributing analysts. By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created an earnings estimates data set that is more accurate than Wall Street up to 69.5% of the time. Recently Estimize has also added economic indicator predictions to its platform as well.

In April, nonfarm payrolls rose 288k while economists had predicted 218k, the Estimize community had a slightly higher forecast of 219k. The nonfarm payrolls number came in much better than expected last month, but investors and economists took it with a grain of salt as the labor force participation rate slid from 63.2% to 62.8%. The shrinking labor force participation rate and surge in added jobs resulted in a reduction of the unemployment rate from 6.7% to 6.3% while the Estimize community only expected the rate to fall marginally to 6.6%.

For Friday’s jobs report, Morningstar has the nonfarm payrolls change consensus at 220k jobs added while the consensus from Estimize.com is 10% higher at 243k. The consensus reported from Morningstar also indicates that the unemployment rate may rise slightly to 6.4% while contributing analysts on Estimize are forecasting that unemployment will remain unchanged at 6.3%.

The Estimize community is expecting the number of jobs added in May to be considerably less than the number added in April, but the community is still optimistic that the labor market will outperform predictions from the majority of economists. All eyes on will be on the Labor Department’s report at 8:30 AM EST on Friday.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI